Business, 25.07.2019 11:50 meramera50

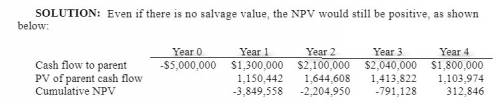

Assume that baps corporation is considering the establishment of a subsidiary in norway. the initial investment required by the parent is $5,000,000. if the project is undertaken, baps would terminate the project after four years. baps' cost of capital is 13%, and the project is of the same risk as baps' existing projects. all cash flows generated from the project will be remitted to the parent at the end of each year. listed below are the estimated cash flows the norwegian subsidiary will generate over the project's lifetime in norwegian kroner (nok): the current exchange rate of the norwegian kroner is $0.135. baps' exchange rate forecast for the norwegian kroner over the project's lifetime is listed below: baps believes that nok8,000,000 of the cash flow in year 4 is a fair estimate of the project's salvage value, so that the cash flow in year 4 is nok12,000,000 without the salvage value. however, baps realizes that the salvage value may be different from nok8,000,000 and wishes to determine the break-even salvage value, which is

Answers: 1

Another question on Business

Business, 22.06.2019 08:00

Compare the sources of consumer credit(there's not just one answer)1. consumers use a prearranged loan using special checks2. consumers use cards with no interest and non -revolving balances3. consumers pay off debt and credit is automatically renewed4. consumers take out a loan with a repayment date and have a specific purposea. travel and entertainment creditb. revolving check creditc. closed-end creditd. revolving credit

Answers: 2

Business, 22.06.2019 11:00

Your debit card is stolen, and you report it to your bank within two business days. how much money can you lose at most? a. $500 b. $25 c. $50 d. $150

Answers: 2

Business, 22.06.2019 21:20

What business practice contributed most to andrew carnegie’s ability to form a monopoly?

Answers: 1

Business, 22.06.2019 22:50

For 2016, gourmet kitchen products reported $22 million of sales and $19 million of operating costs (including depreciation). the company has $15 million of total invested capital. its after-tax cost of capital is 10%, and its federal-plus-state income tax rate was 36%. what was the firm’s economic value added (eva), that is, how much value did management add to stockholders’ wealth during 2016?

Answers: 1

You know the right answer?

Assume that baps corporation is considering the establishment of a subsidiary in norway. the initial...

Questions

Computers and Technology, 29.03.2021 18:20

Mathematics, 29.03.2021 18:20

Biology, 29.03.2021 18:20

Mathematics, 29.03.2021 18:20

English, 29.03.2021 18:20

Mathematics, 29.03.2021 18:20

Mathematics, 29.03.2021 18:20

Physics, 29.03.2021 18:20

English, 29.03.2021 18:20

Mathematics, 29.03.2021 18:20