Business, 22.07.2019 16:40 TheOneandOnly003

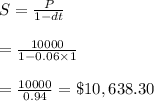

Max murphey, a cash basis taxpayer, borrowed $10,000 from a bank for a business loan on august 1, to be repaid one year later. the interest for one year at 6 percent was deducted from the loan proceeds in advance. his interest deduction for the current year is:

Answers: 1

Another question on Business

Business, 21.06.2019 19:30

What preforms the best over the long term? a) bonds b) mutual funds c) stocks d) certificate of deposit

Answers: 2

Business, 22.06.2019 05:20

Social computing forces companies to deal with customers as opposed to

Answers: 2

Business, 22.06.2019 22:00

Suppose that a paving company produces paved parking spaces (q) using a fixed quantity of land (t) and variable quantities of cement (c) and labor (l). the firm is currently paving 1,000 parking spaces. the firm's cost of cement is $3 comma 600.003,600.00 per acre covered (c) and its cost of labor is $35.0035.00/hour (w). for the quantities of c and l that the firm has chosen, mp subscript upper c baseline equals 60mpc=60 and mp subscript upper l baseline equals 7mpl=7. is this firm minimizing its cost of producing parking spaces?

Answers: 3

Business, 23.06.2019 05:30

What are some examples of types of investments on the part of manufactures that result in growth? how does this improve a nation's standard of living?

Answers: 3

You know the right answer?

Max murphey, a cash basis taxpayer, borrowed $10,000 from a bank for a business loan on august 1, to...

Questions

Mathematics, 14.12.2020 23:40

Mathematics, 14.12.2020 23:40

Mathematics, 14.12.2020 23:40

Mathematics, 14.12.2020 23:40

Geography, 14.12.2020 23:40

Spanish, 14.12.2020 23:40

Mathematics, 14.12.2020 23:40

English, 14.12.2020 23:40

History, 14.12.2020 23:40

Social Studies, 14.12.2020 23:40

Mathematics, 14.12.2020 23:40

Chemistry, 14.12.2020 23:40