Answers: 3

Another question on Business

Business, 22.06.2019 14:00

Bayside coatings company purchased waterproofing equipment on january 2, 20y4, for $190,000. the equipment was expected to have a useful life of four years and a residual value of $9,000. instructions: determine the amount of depreciation expense for the years ended december 31, 20y4, 20y5, 20y6, and 20y7, by (a) the straight-line method and (b) the double-declining-balance method. also determine the total depreciation expense for the four years by each method. depreciation expense year straight-line method double-declining-balance method 20y4 $ $ 20y5 20y6 20y7 total $

Answers: 3

Business, 22.06.2019 17:40

To appeal to a new target market, the maker of hill's coffee has changed the product's package design, reformulated the coffee, begun advertising price discounts in women's magazines, and started distributing the product through gourmet coffee shops. what has been changed? a. the product's perceptual value. b.the product's 4ps. c. the method used in its target marketing. d. the ownership of the product line. e. the product's utility.

Answers: 3

Business, 23.06.2019 02:30

Driving would be more pleasant if we didn't have to put up with the bad habits of other drivers. a newspaper reported the results of a valvoline oil company survey of 500 drivers in which the drivers marked their complaints about other drivers. the top complaints turned out to be tailgating, marked by 24% of the respondents; not using turn signals, marked by 19%; being cut off, marked by 15%; other drivers driving too slowly, marked by 12%; and other drivers being inconsiderate marked by 5%.

Answers: 1

Business, 23.06.2019 12:30

Mason farms purchased a building for $689,000 eight years ago. six years ago, repairs costing $136,000 were made to the building. the annual taxes on the property are $11,000. the building has a current market value of $840,000 and a current book value of $494,000. the building is totally paid for and solely owned by the firm. if the company decides to use this building for a new project, what value, if any, should be included in the initial cash flow of the project for this building? $0$582,000$840,000$865,000$953,000

Answers: 3

You know the right answer?

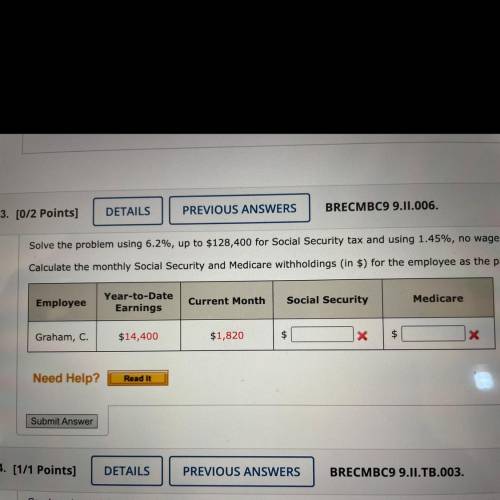

Solve the problem using 6.2%, up to $128,400 for Social Security tax and using 1.45%, no wage limit,...

Questions

Mathematics, 09.09.2020 07:01

Mathematics, 09.09.2020 07:01

Mathematics, 09.09.2020 07:01

Mathematics, 09.09.2020 07:01

Mathematics, 09.09.2020 07:01

Spanish, 09.09.2020 07:01

History, 09.09.2020 07:01

Chemistry, 09.09.2020 07:01

Mathematics, 09.09.2020 07:01

Mathematics, 09.09.2020 07:01

Mathematics, 09.09.2020 07:01

English, 09.09.2020 07:01

Mathematics, 09.09.2020 07:01

Mathematics, 09.09.2020 07:01

Mathematics, 09.09.2020 07:01

History, 09.09.2020 07:01

Mathematics, 09.09.2020 07:01

Biology, 09.09.2020 07:01

Mathematics, 09.09.2020 07:01