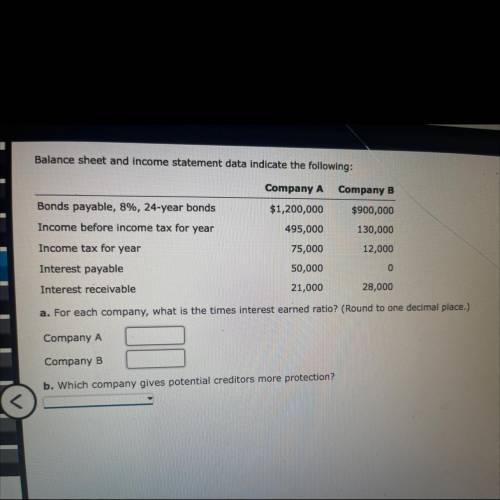

Balance sheet and income statement data indicate the following:

Company A

Company B

Bo...

Business, 04.12.2021 19:20 kitttimothy55

Balance sheet and income statement data indicate the following:

Company A

Company B

Bonds payable, 8%, 24-year bonds

Income before income tax for year

$1,200,000

$900,000

495,000

130,000

Income tax for year

75,000

12,000

Interest payable

50,000

Interest receivable

21,000

28,000

a. For each company, what is the times interest earned ratio? (Round to one decimal place.)

Company A

Company B

b. Which company gives potential creditors more protection?

Answers: 3

Another question on Business

Business, 21.06.2019 19:00

Minolta inc. is considering a project that has the following cash flow and wacc data. what is the project's mirr? note that a project's projected mirr can be less than the wacc (and even negative), in which case it will be rejected. wacc: 10.00% year 0 1 2 3 4 cash flows -$850 300 $320 $340 $360

Answers: 3

Business, 21.06.2019 20:30

Which of the following government agencies is responsible for managing the money supply in the united states? a. the u.s. mint b. the federal reserve bank c. congress d. the department of the treasury 2b2t

Answers: 3

Business, 22.06.2019 04:30

4. the condition requires that only one of the selected criteria be true for a record to be displayed.

Answers: 1

Business, 22.06.2019 05:40

Grant, inc., acquired 30% of south co.’s voting stock for $200,000 on january 2, year 1, and did not elect the fair value option. the price equaled the carrying amount and the fair value of the interest purchased in south’s net assets. grant’s 30% interest in south gave grant the ability to exercise significant influence over south’s operating and financial policies. during year 1, south earned $80,000 and paid dividends of $50,000. south reported earnings of $100,000 for the 6 months ended june 30, year 2, and $200,000 for the year ended december 31, year 2. on july 1, year 2, grant sold half of its stock in south for $150,000 cash. south paid dividends of $60,000 on october 1, year 2. before income taxes, what amount should grant include in its year 1 income statement as a result of the investment?

Answers: 1

You know the right answer?

Questions

Mathematics, 17.10.2020 06:01

History, 17.10.2020 06:01

History, 17.10.2020 06:01

History, 17.10.2020 06:01

Mathematics, 17.10.2020 06:01

History, 17.10.2020 06:01

Mathematics, 17.10.2020 06:01

Social Studies, 17.10.2020 06:01

Chemistry, 17.10.2020 06:01

History, 17.10.2020 06:01

Mathematics, 17.10.2020 06:01