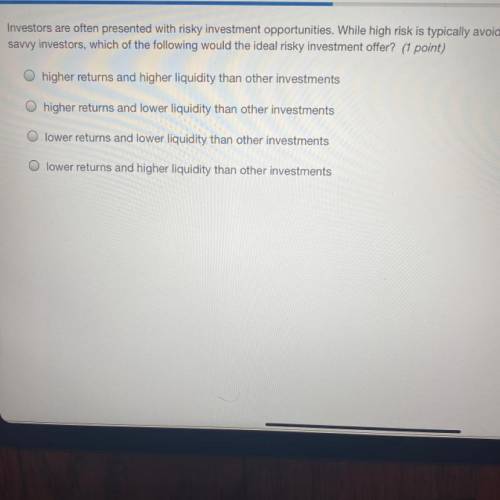

Investors are often presented with risky investment opportunities. While high risk is typically avoided by

savvy investors, which of the following would the ideal risky investment offer? (1 point)

O higher returns and higher liquidity than other investments

O higher returns and lower liquidity than other investments

O

o

O

lower returns and lower liquidity than other investments

O lower returns and higher liquidity than other investments

Answers: 1

Another question on Business

Business, 22.06.2019 19:00

Consider the following information on stocks a, b, c and their returns (in decimals) in each state: state prob. of state a b c boom 20% 0.27 0.22 0.16 good 45% 0.16 0.09 0.07 poor 25% 0.03 0 0.03 bust 10% -0.08 -0.04 -0.02 if your portfolio is invested 25% in a, 40% in b, and 35% in c, what is the standard deviation of the portfolio in percent? answer to two decimals, carry intermediate calcs. to at least four decimals.

Answers: 2

Business, 22.06.2019 20:00

What is the difference between total utility and marginal utility? a. marginal utility is subject to the law of diminishing marginal utility while total utility is not. b. total utility represents the consumer optimum while marginal utility gives the total utility per dollar spent on the last unit. c. total utility is the total amount of satisfaction derived from consuming a certain amount of a good while marginal utility is the additional satisfaction gained from consuming an additional unit of the good. d. marginal utility represents the consumer optimum while total utility gives the total utility per dollar spent on the last unit.

Answers: 3

Business, 22.06.2019 21:00

Describe what fixed costs and marginal costs mean to a company.

Answers: 1

Business, 22.06.2019 21:10

You are the manager of a large crude-oil refinery. as part of the refining process, a certain heat exchanger (operated at high temperatures and with abrasive material flowing through it) must be replaced every year. the replacement and downtime cost in the first year is $165 comma 000. this cost is expected to increase due to inflation at a rate of 7% per year for six years (i.e. until the eoy 7), at which time this particular heat exchanger will no longer be needed. if the company's cost of capital is 15% per year, how much could you afford to spend for a higher quality heat exchanger so that these annual replacement and downtime costs could be eliminated?

Answers: 1

You know the right answer?

Investors are often presented with risky investment opportunities. While high risk is typically avoi...

Questions

English, 11.11.2019 18:31

Health, 11.11.2019 18:31

Geography, 11.11.2019 18:31

Mathematics, 11.11.2019 18:31

Computers and Technology, 11.11.2019 18:31

Mathematics, 11.11.2019 18:31

English, 11.11.2019 18:31

Mathematics, 11.11.2019 18:31

English, 11.11.2019 18:31

Biology, 11.11.2019 18:31

Mathematics, 11.11.2019 18:31