Business, 18.09.2021 01:00 madisontrosclair2

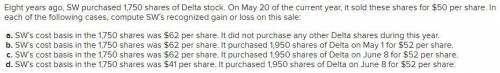

Eight years ago, SW purchased 1,750 shares of Delta stock. On May 20 of the current year, it sold these shares for $50 per share. SW’s cost basis in the 1,750 shares was $41 per share. It purchased 1,950 shares of Delta on June 8 for $52 per share. How do you compute SW’s recognized gain?

Answers: 2

Another question on Business

Business, 22.06.2019 18:00

What would not cause duff beer’s production possibilities curve to expand in the short run? a. improved manufacturing technology b. additional resources c. increased demand

Answers: 1

Business, 22.06.2019 21:10

Skychefs, inc. prepares in-flight meals for a number of major airlines. one of the company's products is grilled salmon in dill sauce with baby new potatoes and spring vegetables. during the most recent week, the company prepared 4000 of these meals using 960 direct labor hours. the company paid these direct labor workers a total of $19,200 for this work, or $20.00 per hour. according to standard cost card for this meal, it should require 0.25 direct labour-hours at a cost of $19.75 per hour.1. what is the standard labor-hours allowed (sh) to prepare 4,000 meals? 2. what is the standard labor cost allowed (sh x sr) to prepare 4,000 meals? 3. what is the labor spending variance? 4. what is the labor rate variance and the labor efficiency variance?

Answers: 3

Business, 23.06.2019 00:40

The recognition of which of the following expenses exemplifies the application of matching expenses with the revenues they produced? multiple choice(a) cost of goods sold. (b) advertising.(c) president's salary.(d) research and development.

Answers: 3

Business, 23.06.2019 11:00

Comparative financial statements for weller corporation, a merchandising company, for the year ending december 31 appear below. the company did not issue any new common stock during the year. a total of 800,000 shares of common stock were outstanding. the interest rate on the bonds, which were sold at their face value, was 12%. the income tax rate was 40% and the dividend per share of common stock was $0.40 this year. the market value of the company's common stock at the end of the year was $18. all of the company's sales are on account. time interest earned ratio

Answers: 3

You know the right answer?

Eight years ago, SW purchased 1,750 shares of Delta stock. On May 20 of the current year, it sold th...

Questions

Mathematics, 28.06.2021 14:00

Mathematics, 28.06.2021 14:00

Physics, 28.06.2021 14:00

Biology, 28.06.2021 14:00

Mathematics, 28.06.2021 14:00

English, 28.06.2021 14:00

Geography, 28.06.2021 14:00

Mathematics, 28.06.2021 14:00

Chemistry, 28.06.2021 14:00

Mathematics, 28.06.2021 14:00

History, 28.06.2021 14:00

Social Studies, 28.06.2021 14:00