Business, 09.09.2021 02:40 nikejose11

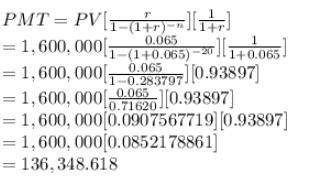

Prof. Business will have $1,600,000 saved up by retirement at age 65. The retired professor expects to live 20 more years after retiring. How large of an annual annuity withdrawal can prof. Finance make at the beginning of each year under this scenario from an account paying 6. 5% compounded annually? round your answer to the nearest dollar.

Answers: 2

Another question on Business

Business, 21.06.2019 23:10

Kando company incurs a $9 per unit cost for product a, which it currently manufactures and sells for $13.50 per unit. instead of manufacturing and selling this product, the company can purchase product b for $5 per unit and sell it for $12 per unit. if it does so, unit sales would remain unchanged and $5 of the $9 per unit costs assigned to product a would be eliminated. 1. prepare incremental cost analysis. should the company continue to manufacture product a or purchase product b for resale? (round your answers to 2 decimal places.)

Answers: 1

Business, 22.06.2019 11:00

Aprofessional does specialized work that's primarily: degree based. medical or legal. well paying. intellectual and creative

Answers: 2

Business, 22.06.2019 16:30

Which of the following has the largest impact on opportunity cost

Answers: 2

You know the right answer?

Prof. Business will have $1,600,000 saved up by retirement at age 65. The retired professor expects...

Questions

English, 09.01.2020 19:31

Mathematics, 09.01.2020 19:31

English, 09.01.2020 19:31

Physics, 09.01.2020 19:31

Biology, 09.01.2020 19:31

Business, 09.01.2020 19:31

Mathematics, 09.01.2020 19:31

Mathematics, 09.01.2020 19:31

English, 09.01.2020 19:31