Business, 30.07.2021 08:00 neonaandrews10

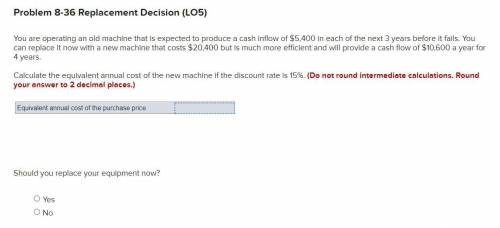

You are operating an old machine that is expected to produce a cash inflow of $5,400 in each of the next 3 years before it fails. You can replace it now with a new machine that costs $20,400 but is much more efficient and will provide a cash flow of $10,600 a year for 4 years.

Calculate the equivalent annual cost of the new machine if the discount rate is 15%. (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Should you replace your equipment now?

multiple choice

Yes

No

Answers: 3

Another question on Business

Business, 22.06.2019 07:40

Alicia has a collision deductible of $500 and a bodily injury liability coverage limit of $50,000. she hits another driver and injures them severely. the case goes to trial and there is a verdict to compensate the injured person for $40,000 how much does she pay?

Answers: 1

Business, 22.06.2019 10:30

Trecek corporation incurs research and development costs of $625,000 in 2017, 30 percent of which relate to development activities subsequent to ias 38 criteria having been met that indicate an intangible asset has been created. the newly developed product is brought to market in january 2018 and is expected to generate sales revenue for 10 years. assume that a u.s.–based company is issuing securities to foreign investors who require financial statements prepared in accordance with ifrs. thus, adjustments to convert from u.s. gaap to ifrs must be made. ignore income taxes. required: (a) prepare journal entries for research and development costs for the years ending december 31, 2017, and december 31, 2018, under (1) u.s. gaap and (2) ifrs. (c) prepare the entry(ies) that trecek would make on the december 31, 2017, and december 31, 2018, conversion worksheets to convert u.s. gaap balances to ifrs.

Answers: 1

Business, 22.06.2019 11:30

Mark knopf is an auditor who has been asked to provide an audit and financial statement certification for a company that is going public on the new york stock exchange. knopf wants to know his personal liability if the company provides him with inaccurate or false information. which of the following sources of law will him answer that question? a. the city ordinances where the company headquarters is located. b. the state constitution of the state where the company is incorporated. c. code of federal regulations. d. all of the above

Answers: 1

Business, 22.06.2019 12:40

Kumar consulting operates several stock investment portfolios that are used by firms for investment of pension plan assets. last year, one portfolio had a realized return of 12.6 percent and a beta coefficient of 1.15. the average t-bond rate was 7 percent and the realized rate of return on the s& p 500 was 12 percent. what was the portfolio's alpha?

Answers: 1

You know the right answer?

You are operating an old machine that is expected to produce a cash inflow of $5,400 in each of the...

Questions

Mathematics, 21.12.2020 14:00

Biology, 21.12.2020 14:00

Health, 21.12.2020 14:00

English, 21.12.2020 14:00

Mathematics, 21.12.2020 14:00

Mathematics, 21.12.2020 14:00

Mathematics, 21.12.2020 14:00

Business, 21.12.2020 14:00

Mathematics, 21.12.2020 14:00

German, 21.12.2020 14:00

Mathematics, 21.12.2020 14:00

English, 21.12.2020 14:00