Dynamic Futon forecasts the following purchases from suppliers:

Jan. Feb. Mar. Apr. May Jun.

...

Business, 08.07.2021 19:20 alexus6339

Dynamic Futon forecasts the following purchases from suppliers:

Jan. Feb. Mar. Apr. May Jun.

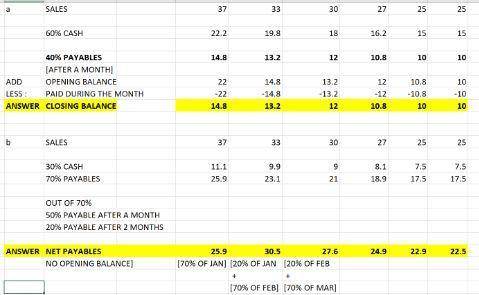

Value of goods ($ millions) 37 33 30 27 25 25

a. Sixty percent of goods are supplied cash-on-delivery. The remainder are paid with an average delay of 1 month. If Dynamic Futon starts the year with payables of $27 million, what is the forecasted level of payables for each month?

b. Suppose that, from the start of the year, the company stretches payables by paying 50% after 1 month and 20% after 2 months. (The remainder continue to be paid cash-on-delivery.) Recalculate payables for each month assuming that there are no cash penalties for late payment. Assume that Dynamic Futon didn't have any payable balance at the start of the year.

Answers: 3

Another question on Business

Business, 22.06.2019 19:10

Robin hood has hired you as his new strategic consultant to him successfully transform his social change enterprise. robin has told you that he counting on your strategic management knowledge to him and his merrymen achieve their goals. discuss in detail what you think should be robin’s two primary strategic goals and continue by also explaining your analytical reasons that support your recommendations.

Answers: 3

Business, 22.06.2019 22:00

Which of the following is a function performed by market prices? a. market prices communicate information to buyers and sellers. b. market prices coordinate the decisions of buyers and sellers. c. market prices motivate entrepreneurs to produce those products that are currently most desired relative to their costs of production. d. all of the above are functions performed by market prices.

Answers: 2

Business, 22.06.2019 22:40

In a fixed-term, level-payment reverse mortgage, sometimes called a reverse annuity mortgage, or ram, a lender agrees to pay the homeowner a monthly payment, or annuity, and expects to be repaid from the homeowner’s equity when he or she sells the home or obtains other financing to pay off the ram. consider a household that owns a $150,000 home free and clear of mortgage debt. the ram lender agrees to a $100,000 ram for 10 years at 6 percent. assume payments are made annually, at the beginning of each year to the homeowner. calculate the annual payment on the ram.

Answers: 1

Business, 23.06.2019 00:30

Suppose the government decides to issue a new savings bond that is guaranteed to double in value if you hold it for 20 years. assume you purchase a bond that costs $25. a. what is the exact rate of return you would earn if you held the bond for 20 years until it doubled in value? (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. if you purchased the bond for $25 in 2017 at the then current interest rate of .27 percent year, how much would the bond be worth in 2027? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. in 2027, instead of cashing in the bond for its then current value, you decide to hold the bond until it doubles in face value in 2037. what annual rate of return will you earn over the last 10 years? (do not

Answers: 3

You know the right answer?

Questions

Mathematics, 16.10.2020 15:01

French, 16.10.2020 15:01

History, 16.10.2020 15:01

Mathematics, 16.10.2020 15:01

Mathematics, 16.10.2020 15:01

Mathematics, 16.10.2020 15:01

Biology, 16.10.2020 15:01

History, 16.10.2020 15:01

Mathematics, 16.10.2020 15:01

Mathematics, 16.10.2020 15:01

Mathematics, 16.10.2020 15:01