Business, 25.06.2021 05:00 amiechap12

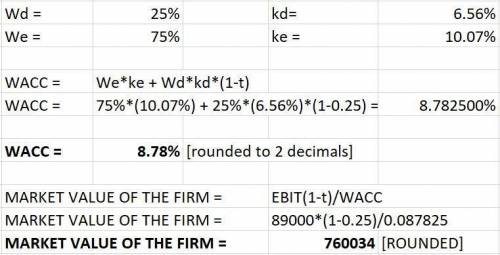

The Anson Jackson Court (AJC) currently has $150,000 market value (and book value) of perpetual debt outstanding carrying a coupon rate of 6%. Its earnings before interest and taxes (EBIT) are $89,000, and it is a zero growth company. AJC's current cost of equity is 10%, and its tax rate is 25%. The firm has 10,000 shares of common stock outstanding selling at a price per share of $60.00. Refer to the data for Anson Jackson Court (AJC). AJC is considering moving to a capital structure that is comprised of 25% debt and 75% equity, based on market values. The new funds would be used to replace the old debt and to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on debt to rise to 6.56%, while the required rate of return on equity would rise to 10.07%. If this plan were carried out, what would be AJC's new WACC and total value

Answers: 2

Another question on Business

Business, 22.06.2019 05:10

1. descriptive statistics quickly describe large amounts of data can predict future stock returns with surprising accuracy statisticians understand non-numeric information, like colors refer mainly to patterns that can be found in data 2. a 15% return on a stock means that 15% of the original purchase price of the stock returns to the seller at the end of the year 15% of the people who purchased the stock will see a return the stock is worth 15% more at the end of the year than at the beginning the stock has lost 15% of its value since it was originally sold 3. a stock purchased on january 1 cost $4.35 per share. the same stock, sold on december 31 of the same year, brought in $4.75 per share. what was the approximate return on this stock? 0.09% 109% 1.09% 9% 4. a stock sells for $6.99 on december 31, providing the seller with a 6% annual return. what was the price of the stock at the beginning of the year? $6.59 $1.16 $7.42 $5.84

Answers: 3

Business, 22.06.2019 06:00

Transactions on april 1 of the current year, andrea byrd established a business to manage rental property. she completed the following transactions during april: opened a business bank account with a deposit of $45,000 from personal funds. purchased office supplies on account, $2,000. received cash from fees earned for managing rental property, $8,500. paid rent on office and equipment for the month, $5,000. paid creditors on account, $1,375. billed customers for fees earned for managing rental property, $11,250. paid automobile expenses for month, $840, and miscellaneous expenses, $900. paid office salaries, $3,600. determined that the cost of supplies on hand was $550; therefore, the cost of supplies used was $1,450. withdrew cash for personal use, $2,000. required: 1. indicate the effect of each transaction and the balances after each transaction: for those boxes in which no entry is required, leave the box blank. for those boxes in which you must enter subtractive or negative numbers use a minus sign. (example: -300)

Answers: 1

Business, 22.06.2019 14:30

If a product goes up in price, and the demand for it drops, that product's demand is a. elastic b. inelastic c. stable d. fixed select the best answer from the choices provided

Answers: 1

Business, 22.06.2019 18:00

Match the different financial task to their corresponding financial life cycle phases

Answers: 3

You know the right answer?

The Anson Jackson Court (AJC) currently has $150,000 market value (and book value) of perpetual debt...

Questions

Mathematics, 27.08.2019 03:30

Mathematics, 27.08.2019 03:30

English, 27.08.2019 03:30

Chemistry, 27.08.2019 03:30

Mathematics, 27.08.2019 03:30

Chemistry, 27.08.2019 03:30

Biology, 27.08.2019 03:30

Social Studies, 27.08.2019 03:30

Mathematics, 27.08.2019 03:30

Mathematics, 27.08.2019 03:30

English, 27.08.2019 03:30

English, 27.08.2019 03:30

Biology, 27.08.2019 03:30