Business, 21.06.2021 22:00 ellie55991

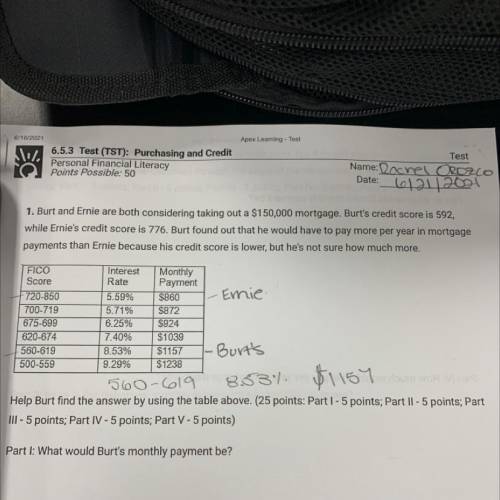

1. Burt and Ernie are both considering taking out a $150,000 mortgage. Burt's credit score is 592,

while Ernie's credit score is 776. Burt found out that he would have to pay more per year in mortgage

payments than Ernie because his credit score is lower, but he's not sure how much more.

Interest

Rate

Ernie

FICO

Score

720-850

700-719

675-699

620-674

560-619

500-559

5.59%

5.71%

6.25%

7.40%

8.53%

9.29%

Monthly

Payment

$860

$872

$924

$1039

$1157

$1238

Burt's

8537. $1154

560

Help Burt find the answer by using the table above. (25 points: Part 1 - 5 points; Part II - 5 points; Part

III - 5 points; Part IV - 5 points; Part V-5 points)

Part I: What would Burt's monthly payment be?

Answers: 1

Another question on Business

Business, 22.06.2019 11:30

(select all that apply) examples of email use that could be considered unethical include denying receiving an e-mail requesting that you work late forwarding a chain letter asking for donations to a good cause sending a quick message to your friend about last weekend sending your boss the monthly sales figures in an attachment setting up a meeting with your co-worker sharing a funny joke with other employees

Answers: 2

Business, 22.06.2019 15:30

For a firm that uses the weighted average method of process costing, which of the following must be true? (a) physical units can be greater than or less than equivalent units. (b) physical units must be equal to equivalent units. (c) equivalent units must be greater than or equal to physical units. (d) physical units must be greater than or equal to equivalent units.

Answers: 1

Business, 22.06.2019 15:40

Rachel died in 2014 and her executor is finalizing her estate tax return. the executor has determined that rachel’s adjusted gross estate is $10,120,000 and that her estate is entitled to a charitable deduction in the amount of $500,000. using 2014 rates, calculate the estate tax liability for rachel’s estate.

Answers: 1

Business, 22.06.2019 20:00

Ryngard corp's sales last year were $38,000, and its total assets were $16,000. what was its total assets turnover ratio (tato)? a. 2.04b. 2.14c. 2.26d. 2.38e. 2.49

Answers: 1

You know the right answer?

1. Burt and Ernie are both considering taking out a $150,000 mortgage. Burt's credit score is 592,...

Questions

Biology, 12.07.2019 08:30

History, 12.07.2019 08:30

Health, 12.07.2019 08:30

History, 12.07.2019 08:30

Mathematics, 12.07.2019 08:30

Computers and Technology, 12.07.2019 08:30

Mathematics, 12.07.2019 08:30

Chemistry, 12.07.2019 08:30

Geography, 12.07.2019 08:30