Business, 09.06.2021 19:20 samiller30

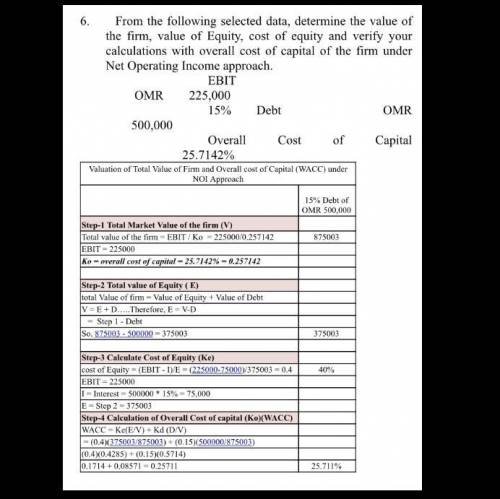

From the following selected data, determine the value of the firm, value of Equity, cost of equity and verify your calculations with overall cost of capital of the firm under Net Operating Income approach.

EBIT OMR225,000

15% Debt OMR 500,000

Overall Cost of Capital 25.7142%

Valuation of Total Value of Firm and Overall cost of Capital (WACC) under NOI Approach

15% Debt of OMR 500,000

Step-1 Total Market Value of the firm (V)

Total value of the firm = EBIT / Ko = 225000/0.257142

875003

EBIT = 225000

Ko = overall cost of capital = 25.7142% = 0.257142

Step-2 Total value of Equity ( E)

total Value of firm = Value of Equity + Value of Debt

V = E + D…..Therefore, E = V-D

= Step 1 - Debt

So, 875003 - 500000 = 375003

375003

Step-3 Calculate Cost of Equity (Ke)

cost of Equity = (EBIT - I)/E = (225000-75000)/375003 = 0.4

40%

EBIT = 225000

I = Interest = 500000 * 15% = 75,000

E = Step 2 = 375003

Step-4 Calculation of Overall Cost of capital (Ko)(WACC)

WACC = Ke(E/V) + Kd (D/V)

= (0.4)(375003/875003) + (0.15)(500000/875003)

(0.4)(0.4285) + (0.15)(0.5714)

0.1714 + 0.08571 = 0.25711

25.711%

Answers: 3

Another question on Business

Business, 22.06.2019 07:30

Why has the free enterprise system been modified to include some government intervention?

Answers: 1

Business, 22.06.2019 08:30

Uppose that the federal reserve purchases a bond for $100,000 from donald truck, who deposits the proceeds in the manufacturer’s national bank. what will be the impact of this purchase on the supply of money? the money supply will increase by $100,000. the money supply will increase by $80,000. the money supply will increase by $500,000. this action will have no effect on the money supply. if the reserve requirement ratio is 20 percent, what is the maximum amount of additional loans that the manufacturer’s bank will be able to extend as the result of truck’s deposit? the maximum additional loans is $100,000. the maximum additional loans is $80,000. the maximum additional loans is $20,000. the maximum additional loans is $500,000. given the 20 percent reserve requirement, what is the maximum increase in the quantity of checkable deposits that could result throughout the entire banking system because of the fed’s action? this action will have no effect on the money supply. the money supply will eventually increase by $80,000. the money supply will eventually increase by $500,000. the money supply will eventually increase by $100,000.

Answers: 1

Business, 22.06.2019 20:30

The former chairman of the federal reserve, alan greenspan, used the term "irrational exuberance" in 1996 to describe the high levels of optimism among stock market investors at the time. stock market indexes such as the s& p composite price index were at an all-time high. some commentators believed that the fed should intervene to slow the expansion of the economy. why would central banks want to clamp down when the economy is growing? a. to block the formation of unsustainable speculative asset bubbles. b. to curtail excessive profits in the banking system. c. to prevent inflationary forces from gathering momentum. d. all of the above. e. a and c only.

Answers: 3

Business, 22.06.2019 21:30

Providing a great shopping experience to customers is one of the important objectives of purple fashions inc., a clothing store. to achieve this objective, the company has a team of committed customer service professionals whose job is to ensure that customers get exactly what they want. this scenario illustrates that purple fashions is trying to achieve

Answers: 1

You know the right answer?

From the following selected data, determine the value of the firm, value of Equity, cost of equity a...

Questions

Mathematics, 05.02.2020 02:58

History, 05.02.2020 02:59

History, 05.02.2020 02:59

Mathematics, 05.02.2020 02:59

Mathematics, 05.02.2020 02:59

History, 05.02.2020 02:59

Mathematics, 05.02.2020 02:59

Mathematics, 05.02.2020 02:59

History, 05.02.2020 02:59

English, 05.02.2020 02:59

Biology, 05.02.2020 02:59

Biology, 05.02.2020 02:59