Business, 07.06.2021 17:40 mistermansour07

A measure of risk-adjusted performance that is often used is the Sharpe ratio. The Sharpe ratio is calculated as the risk premium of an asset divided by its standard deviation. The standard deviations and returns of the funds over the past 10 years are listed here. Calculate the Sharpe ratio for each of these funds. Assume that the expected return and standard deviation of the company stock will be 16 percent and 58 percent. Calculate the Sharpe ratio for the company stock. How appropriate is the Sharpe ratio for these assets? When would you use the Sharpe ratio?

10-YEAR ANNUAL RETURN STANDARD DEVIATION

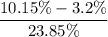

Bledsoe S&P 500 Index Fund 10.15% 23.85%

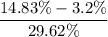

Bledsoe Small Cap Fund 14.83 29.62

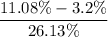

Bledsoe Large Company Stock Fund 11.08 26.13

Bledsoe Bond Fund 8.15 10.34

Answers: 1

Another question on Business

Business, 21.06.2019 21:00

Intronix uses copy editors, computer graphics specialists, and java programmers to produce ads for magazines and the internet. the average new ad for magazines typically requires 180 hours of a copy editor's time and 135 hours of a computer graphics specialist's time, whereas ads produced for the internet require 35 hours of copy editor time, 195 hours of computer graphics time, and 60 hours of a java programmer's time. lassie food, a dog food manufacturer, has hired intronix to produce ads in the next four week. although currently it considers magazine ads 3 times more valuable than internet ads, it still wishes to have at least 2 of each produced within the next four weeks. intronix has assigned up to 3 copy editors, 4 computer graphics specialists, and 1 java programmer, each committed to work up to 70 hours per week on the project. how many of each type of ad should be produced to maximize the overall value to lassie foods

Answers: 3

Business, 21.06.2019 21:30

Afreezer manufacturer might purchase sheets of steel, wiring, shelving, and so forth, as part of its final product. this is an example of what sub-classification of business market?

Answers: 1

Business, 22.06.2019 00:00

Ok, so, theoretical question: if i bought the mona lisa legally, would anyone be able to stop me from eating it? why or why not?

Answers: 1

Business, 22.06.2019 12:50

You are working on a bid to build two city parks a year for the next three years. this project requires the purchase of $249,000 of equipment that will be depreciated using straight-line depreciation to a zero book value over the three-year project life. ignore bonus depreciation. the equipment can be sold at the end of the project for $115,000. you will also need $18.000 in net working capital for the duration of the project. the fixed costs will be $37000 a year and the variable costs will be $148,000 per park. your required rate of return is 14 percent and your tax rate is 21 percent. what is the minimal amount you should bid per park? (round your answer to the nearest $100) (a) $214,300 (b) $214,100 (c) $212,500 (d) $208,200 (e) $208,400

Answers: 3

You know the right answer?

A measure of risk-adjusted performance that is often used is the Sharpe ratio. The Sharpe ratio is c...

Questions

Biology, 29.07.2019 06:30

Chemistry, 29.07.2019 06:30

Mathematics, 29.07.2019 06:30

History, 29.07.2019 06:30

History, 29.07.2019 06:30

World Languages, 29.07.2019 06:30

Mathematics, 29.07.2019 06:30

History, 29.07.2019 06:30

Biology, 29.07.2019 06:30

History, 29.07.2019 06:30

Social Studies, 29.07.2019 06:30

English, 29.07.2019 06:30

Biology, 29.07.2019 06:30

Mathematics, 29.07.2019 06:30

Spanish, 29.07.2019 06:30

= return of portfolio asset

= return of portfolio asset wasn't given, So let's assume that the risk-free rate

wasn't given, So let's assume that the risk-free rate