Business, 02.06.2021 17:00 SMURFETTE86

Assignment Topic:

Critically analyze a listed firm’s fair value accounting (IFRS 13), revenue (IFRS 15), leases (IFRS 16),

corporate governance and audit characteristics over time and answer the research question “are

fair values and other accounting estimates a true reflection of the company’s performance?”

REQUIRED:

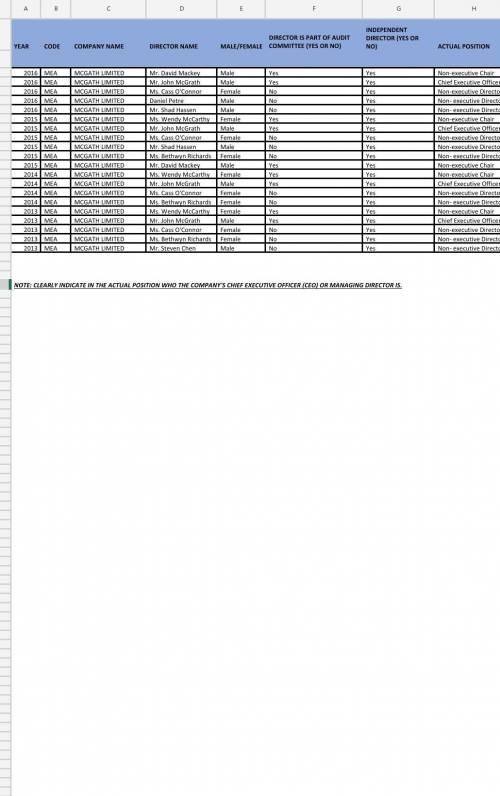

1. Collecting basic financial and corporate governance data from a listed firm’s annual reports.

An Excel template is provided for each group with firm-years aligned for the group. You are

required to fill the excel properly and clearly. The data you collect will be used in your essay.

The following 2-4 are essay requirements.

2. Critically analyze:

3. Discuss the firm’s corporate governance and ownership structure and provide suggestions on

how to improve. You are required to discuss whether its corporate governance is good, based on

the board and audit committee characteristics. What is the advantage of proper board and type

of valuers in relation to fair value accounting? [You could discuss the firm’s board size, whether

CEO and chairperson are the same person, how many independent directors, female directors,

shareholder information, internal valuers or external valuers etc.]

Answers: 2

Another question on Business

Business, 22.06.2019 11:40

Jamie is saving for a trip to europe. she has an existing savings account that earns 3 percent annual interest and has a current balance of $4,200. jamie doesn’t want to use her current savings for vacation, so she decides to borrow the $1,600 she needs for travel expenses. she will repay the loan in exactly one year. the annual interest rate is 6 percent. a. if jamie were to withdraw the $1,600 from her savings account to finance the trip, how much interest would she forgo? .b. if jamie borrows the $1,600 how much will she pay in interest? c. how much does the trip cost her if she borrows rather than dip into her savings?

Answers: 1

Business, 22.06.2019 14:30

United continental holdings, inc., (ual), operates passenger service throughout the world. the following data (in millions) were adapted from a recent financial statement of united. sales (revenue) $38,901 average property, plant, and equipment 17,219 average intangible assets 8,883 1. compute the asset turnover. round your answer to two decimal places.

Answers: 2

Business, 22.06.2019 17:50

Abc factory produces 24,000 units. the cost sheet gives the following information: direct materials rs. 1,20,000direct labour rs. 84,000variable overheads rs. 48,000semi variable overheads rs. 28,000fixed overheads rs. 80,000total cost rs. 3,60,000presently the product is sold at rs. 20 per unit.the management proposes to increase the production by 3,000 units for sales in the foreign market . it is estimated that semi variable overheads will increase by rs. 1,000. but the product will be sold at rs. 14 per unit in the foreign market. however, no additional capital expenditure will be incurredq-1. what is present profit of the company ? q-2. what is proposed profit of the company in new market? q-3.what is suggestion for new makret proposal whether proposal accept or not

Answers: 1

Business, 22.06.2019 20:20

Garcia industries has sales of $200,000 and accounts receivable of $18,500, and it gives its customers 25 days to pay. the industry average dso is 27 days, based on a 365-day year. if the company changes its credit and collection policy sufficiently to cause its dso to fall to the industry average, and if it earns 8.0% on any cash freed-up by this change, how would that affect its net income, assuming other things are held constant? a. $241.45b. $254.16c. $267.54d. $281.62e. $296.44

Answers: 2

You know the right answer?

Assignment Topic:

Critically analyze a listed firm’s fair value accounting (IFRS 13), revenue (IFRS...

Questions

History, 31.07.2019 21:30

History, 31.07.2019 21:30

World Languages, 31.07.2019 21:30

History, 31.07.2019 21:30

Social Studies, 31.07.2019 21:30