Business, 01.06.2021 05:20 milliebbbrown

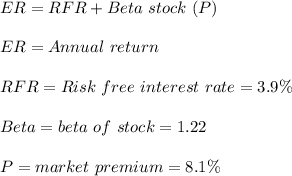

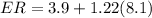

Bama Entertainment has common stock with a beta of 1.22. The market risk premium is 8.1 percent and the risk-free rate is 3.9 percent. What is the expected return on this stock?

a) 13.31 percent

b) 12.67 percent

c) 12.40 percent

d) 13.78 percent

e) 14.13 percent

Answers: 2

Another question on Business

Business, 22.06.2019 00:00

Which statement about the cost of the options is true? she would save $1,000 by choosing option b. she would save $5,650 by choosing option a. she would save $11,200 by choosing option b. she would save $11,300 by choosing option a.

Answers: 2

Business, 22.06.2019 17:30

Gary lives in an area that receives high rainfall and thunderstorms throughout the year. which device would be useful to him to maintain his computer?

Answers: 2

Business, 22.06.2019 20:10

Mikkelson corporation's stock had a required return of 12.50% last year, when the risk-free rate was 3% and the market risk premium was 4.75%. then an increase in investor risk aversion caused the market risk premium to rise by 2%. the risk-free rate and the firm's beta remain unchanged. what is the company's new required rate of return? (hint: first calculate the beta, then find the required return.) do not round your intermediate calculations.

Answers: 2

You know the right answer?

Bama Entertainment has common stock with a beta of 1.22. The market risk premium is 8.1 percent and...

Questions

Health, 09.11.2019 21:31

Computers and Technology, 09.11.2019 21:31

Mathematics, 09.11.2019 21:31

Health, 09.11.2019 21:31

Computers and Technology, 09.11.2019 21:31

Spanish, 09.11.2019 21:31

English, 09.11.2019 21:31

Mathematics, 09.11.2019 21:31

Geography, 09.11.2019 21:31

Mathematics, 09.11.2019 21:31