Business, 27.05.2021 03:50 xwalker6772

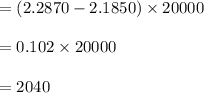

You anticipate your firm will need 20,000 bushels of oats in December so you hedged your position today at the closing price when the daily price quotes were: Open 222, High 225.50, Low 223.50, and Settle 218.50. Assume the actual market quote turns out to be 228.70 on the day you actually acquire the oats. Oats futures contracts are based on 5,000 bushels and priced in cents per bushel. What was your gain or loss from hedging your position

Answers: 1

Another question on Business

Business, 21.06.2019 21:00

Roi analysis using dupont model. charlie? s furniture store has been in business for several years. the firm? s owners have described the store as a ? high-price, highservice? operation that provides lots of assistance to its customers. margin has averaged a relatively high 32% per year for several years, but turnover has been a relatively low 0.4 based on average total assets of $800,000. a discount furniture store is about to open in the area served by charlie? s, and management is considering lowering prices in order to compete effectively. required: a. calculate current sales and roi for charlie? s furniture store. b. assuming that the new strategy would reduce margin to 20%, and assuming that average total assets would stay the same, calculate the sales that would be required to have the same roi as they currently earned. c. suppose that you presented the results of your analysis in parts a and b of this problem to charlie, and he replied, ? what

Answers: 1

Business, 22.06.2019 10:40

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: asset a e(ra) = 18.5% σa = 20% asset b e(rb) = 15% σb = 27% an investor with a risk aversion of a = 3 would find that on a risk-return basis. a. only asset a is acceptable b. only asset b is acceptable c. neither asset a nor asset b is acceptable d. both asset a and asset b are acceptable

Answers: 2

Business, 22.06.2019 13:20

Suppose your rich uncle gave you $50,000, which you plan to use for graduate school. you will make the investment now, you expect to earn an annual return of 6%, and you will make 4 equal annual withdrawals, beginning 1 year from today. under these conditions, how large would each withdrawal be so there would be no funds remaining in the account after the 4th withdraw?

Answers: 3

Business, 22.06.2019 17:30

Gary lives in an area that receives high rainfall and thunderstorms throughout the year. which device would be useful to him to maintain his computer?

Answers: 2

You know the right answer?

You anticipate your firm will need 20,000 bushels of oats in December so you hedged your position to...

Questions

Mathematics, 04.04.2020 03:28

Mathematics, 04.04.2020 03:28

Chemistry, 04.04.2020 03:28

History, 04.04.2020 03:28

Mathematics, 04.04.2020 03:28

History, 04.04.2020 03:29

Mathematics, 04.04.2020 03:29

Spanish, 04.04.2020 03:29

Computers and Technology, 04.04.2020 03:29