Business, 21.05.2021 20:40 elistopchaniuk

CON 3-1 (Algo) Accounting for Operating Activities in a New Business (the Accounting Cycle) LO3-4, 3-5, 3-6

Penny's Pool Service & Supply, Inc. (PPSS) had the following transactions related to operating the business in its first year's busiest quarter ended September 30:

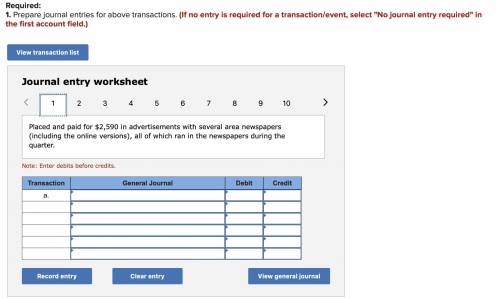

a. Placed and paid for $2,590 in advertisements with several area newspapers (including the online versions), all of which ran in the newspapers during the quarter.

b. Cleaned pools for customers for $18,200, receiving $15,000 in cash with the rest owed by customers who will pay when billed in October.

c. Paid Pool Corporation, Inc., a pool supply wholesaler, $10,500 for inventory received by PPSS in May.

d. As an incentive to maintain customer loyalty, PPSS offered customers a discount for prepaying next year’s pool cleaning service. PPSS received $9,900 from customers who took advantage of the discount.

e. Paid the office receptionist $4,500, with $1,350 owed from work in the prior quarter and the rest from work in the current quarter. Last quarter’s amount was recorded as an expense and a liability, Wages Payable.

f. Had the company van repaired, paying $200 to the mechanic.

g. Paid $200 for phone, water, and electric utilities used during the quarter.

h. Received $130 cash in interest earned during the current quarter on short-term investments.

i. Received a property tax bill for $400 for use of the land and building in the quarter; the bill will be paid next quarter.

j. Paid $1,600 for the next quarter’s insurance coverage.

Required:

1. Prepare journal entries FOR ALL THE ABOVE transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Answers: 2

Another question on Business

Business, 21.06.2019 20:40

•broussard skateboard’s sales are expected to increase by 15% from $8 million in 2016 to $9.2 million in 2017. its assets totaled $5 million at the end of 2016. broussard is already at full capacity, so its assets must grow at the same rate as projected sales. at the end of 2016, current liabilities were $1.4 million, consisting of $450,000 of accounts payable, $500,000 of notes payable, and $450,000 of accruals. the after-tax profit margin is forecasted to be 6%, and the forecasted payout ratio is 40%. use the afn equation to forecast broussard’s additional funds needed for the coming year

Answers: 2

Business, 22.06.2019 20:00

An arithmetic progression involves the addition of the same quantity to each number.which might represent the arithmetic growth of agricultural production

Answers: 3

Business, 22.06.2019 20:10

Given the following information, calculate the savings ratio: liabilities = $25,000 liquid assets = $5,000 monthly credit payments = $800 monthly savings = $760 net worth = $75,000 current liabilities = $2,000 take-home pay = $2,300 gross income = $3,500 monthly expenses = $2,050 multiple choice 2.40% 3.06% 34.78% 33.79% 21.71%

Answers: 2

Business, 22.06.2019 21:00

The purpose of the transportation approach for location analysis is to minimize which of the following? a. total costsb. total fixed costsc. the number of shipmentsd. total shipping costse. total variable costs

Answers: 1

You know the right answer?

CON 3-1 (Algo) Accounting for Operating Activities in a New Business (the Accounting Cycle) LO3-4, 3...

Questions

Health, 15.12.2020 20:40

Mathematics, 15.12.2020 20:40

Mathematics, 15.12.2020 20:40

Mathematics, 15.12.2020 20:40

Advanced Placement (AP), 15.12.2020 20:40

Mathematics, 15.12.2020 20:40

Mathematics, 15.12.2020 20:40

Mathematics, 15.12.2020 20:40

Mathematics, 15.12.2020 20:40

Mathematics, 15.12.2020 20:40

Spanish, 15.12.2020 20:40

Mathematics, 15.12.2020 20:40

Mathematics, 15.12.2020 20:40

Mathematics, 15.12.2020 20:40

Mathematics, 15.12.2020 20:40