Business, 21.05.2021 17:40 cfnewton09

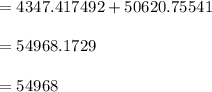

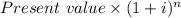

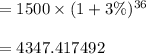

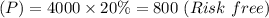

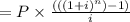

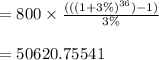

Paulina Lesky is 27 years old and has accumulated $7,500 in her self-directed defined contribution pension plan. Each year she contributes $2,000 to the plan, and her employer contributes an equal amount. Paulina thinks she will retire at age 63 and figures she will live to age 90. The plan allows for two types of investments. One offers a 3% risk-free real rate of return. The other offers an expected return of 12% and has a standard deviation of 39%. Paulina Lesky is 27 years old and has accumulated $7,500 in her self now has 20% of her money in the risk-free investment and 80% in the risky investment. She plans to continue saving at the same rate and keep the same proportions invested in each of the investments. Her salary will grow at the same rate as inflation. How much can Paulina be sure of having in the safe account at retirement?

A) $45,473.

B) $62,557.

C) $78,943.

D) $54,968.

E) $74,643.

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

Agood for which demand increases as income rises is and a good for which demand increases as income falls is

Answers: 1

Business, 22.06.2019 13:20

Suppose your rich uncle gave you $50,000, which you plan to use for graduate school. you will make the investment now, you expect to earn an annual return of 6%, and you will make 4 equal annual withdrawals, beginning 1 year from today. under these conditions, how large would each withdrawal be so there would be no funds remaining in the account after the 4th withdraw?

Answers: 3

Business, 22.06.2019 19:40

Lauer corporation uses the periodic inventory system and has provided the following information about one of its laptop computers: date transaction number of units cost per unit 1/1 beginning inventory 210 $ 910 5/5 purchase 310 $ 1,010 8/10 purchase 410 $ 1,110 10/15 purchase 255 $ 1,160 during the year, lauer sold 1,025 laptop computers. what was cost of goods sold using the lifo cost flow assumption?

Answers: 1

Business, 22.06.2019 21:00

Sue peters is the controller at vroom, a car dealership. dale miller recently has been hired as the bookkeeper. dale wanted to attend a class in excel spreadsheets, so sue temporarily took over dale's duties, including overseeing a fund used for gas purchases before test drives. sue found a shortage in the fund and confronted dale when he returned to work. dale admitted that he occasionally uses the fund to pay for his own gas. sue estimated the shortage at $450. what should sue do?

Answers: 3

You know the right answer?

Paulina Lesky is 27 years old and has accumulated $7,500 in her self-directed defined contribution p...

Questions

History, 26.11.2021 03:10

Arts, 26.11.2021 03:10

Health, 26.11.2021 03:10

History, 26.11.2021 03:10

Social Studies, 26.11.2021 03:10

Biology, 26.11.2021 03:10

History, 26.11.2021 03:10

Mathematics, 26.11.2021 03:10

Geography, 26.11.2021 03:10

a year and the employer corresponds with the same amount for the pension plan.

a year and the employer corresponds with the same amount for the pension plan.

of annuity

of annuity