Business, 19.05.2021 18:50 justyne2004

Brian Cartwright is a single taxpayer who itemizes deductions and has no dependents. Since Year 1, Brian has owned a 50% interest in Technology Plus Inc., an S corporation from which he was paid a salary and received distributions in Year 4 (each paid according to the ratio of ownership). Technology Plus Inc.'s Year 4 income statement is included in the exhibit above. Using the information provided, enter the appropriate values in the associated fields that would appear on the K-1 S corporation tax form for Brian from Technology Plus Inc. in the table below.

Technology Plus Inc.

Condensed Income Statement

December 31, Year 4

Revenue:

Sales $ 225,000

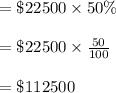

Taxable interest income $ 5,000

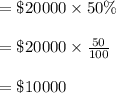

Long-term capital gains $ 40,000

Total revenue

$ 270,000

Expenses:

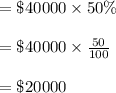

Shareholders' salaries $ 150,000

Cost of goods sold $ 50,000

Operating expenses $ 12,000

Charitable contributions $ 1,000

MACRS depreciation $ 3,000

Section 179 deduction $ 6,000

Total expenses

$ 222,000

Year 4 taxable net income (loss) $ 48,000

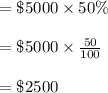

Year 4 distributions to shareholders $20,000

A B

1. Ordinary business income (loss):

2. Net rental income (loss):

3. Interest income:

4. Ordinary dividends

5. Net long-term capital gain (loss):

6. Regular MACRS depreciation:

7. Section 179 deduction:

8. Charitable contributions:

Answers: 1

Another question on Business

Business, 22.06.2019 04:00

Medtronic, inc., is a medical technology company that competes for customers with st. jude medical s.c., inc. james hughes worked for medtronic as a sales manager. his contract prohibited him from working for a competitor for one year after leaving medtronic. hughes sought a position as a sales director for st. jude. st. jude told hughes that his contract with medtronic was unenforceable and offered him a job. hughes accepted. medtronic filed a suit, alleging wrongful interference. which type of interference was most likely the basis for this suit? did it occur here? medtronic, inc., is a medical technology company that competes for customers with st. jude medical s.c., inc. james hughes worked for medtronic as a sales manager. his contract prohibited him from working for a competitor for one year after leaving medtronic

Answers: 2

Business, 22.06.2019 04:30

4. the condition requires that only one of the selected criteria be true for a record to be displayed.

Answers: 1

Business, 22.06.2019 05:50

Cosmetic profits. sally is the executive vice president of big name cosmetics company. through important and material, nonpublic information, she learns that the company is soon going to purchase a smaller chain of stores. it is expected that stock in big name cosmetics will rise dramatically at that point. sally immediately buys a number of shares of her company's stock. she also tells her friend alice about the expected purchase of stores. alice wanted to purchase stock in the company but lacked the funds with which to do so. although she did not have the funds in bank a, alice decided to draw a check on bank a and deposit the check in bank b and then proceed to write a check on bank b to cover the purchase of the stock. she hoped that she would have sufficient funds to deposit before the check was presented for payment. of which of the following offenses, if any, is alice guilty of by buying stock?

Answers: 2

Business, 22.06.2019 13:40

Salge inc. bases its manufacturing overhead budget on budgeted direct labor-hours. the variable overhead rate is $8.10 per direct labor-hour. the company's budgeted fixed manufacturing overhead is $74,730 per month, which includes depreciation of $20,670. all other fixed manufacturing overhead costs represent current cash flows. the direct labor budget indicates that 5,300 direct labor-hours will be required in september. the company recomputes its predetermined overhead rate every month. the predetermined overhead rate for september should be:

Answers: 3

You know the right answer?

Brian Cartwright is a single taxpayer who itemizes deductions and has no dependents. Since Year 1, B...

Questions

Business, 03.08.2019 17:00

Social Studies, 03.08.2019 17:00

Chemistry, 03.08.2019 17:00

English, 03.08.2019 17:00

Social Studies, 03.08.2019 17:00

Biology, 03.08.2019 17:00

Business, 03.08.2019 17:00