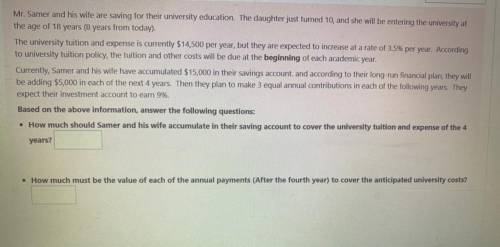

Mr. Samer and his wife are saving for their university education. The daughter just turned 10, and she will be entering the university at

the age of 18 years (8 years from today).

The university tuition and expense is currently $14,500 per year, but they are expected to increase at a rate of 3.5% per year. According

to university tuition policy, the tuition and other costs will be due at the beginning of each academic year.

Currently, Samer and his wife have accumulated $15,000 in their savings account and according to their long-run financial plan, they will

be adding $5,000 in each of the next 4 years. Then they plan to make 3 equal annual contributions in each of the following years. They

expect their investment account to earn 9%.

Based on the above information, answer the following questions:

• How much should Samer and his wife accumulate in their saving account to cover the university tuition and expense of the 4

years?

• How much must be the value of each of the annual payments (After the fourth year) to cover the anticipated university costs?

Answers: 1

Another question on Business

Business, 22.06.2019 09:00

Afood worker has just rinsed a dish after cleaning it.what should he do next?

Answers: 2

Business, 22.06.2019 09:00

Brian has been working for a few years now and has saved a substantial amount of money. he now wants to invest 50 percent of his savings in a bank account where it will be locked for three years and gain interest. which type of bank account should brian open? a. savings account b. money market account c. checking account d. certificate of deposit

Answers: 1

Business, 22.06.2019 11:20

You decided to charge $100 for your new computer game, but people are not buying it. what could you do to encourage people to buy your game?

Answers: 1

Business, 22.06.2019 13:10

Trey morgan is an employee who is paid monthly. for the month of january of the current year, he earned a total of $4,538. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year, and the fica tax rate for medicare is 1.45% of all earnings for both the employee and the employer. the amount of federal income tax withheld from his earnings was $680.70. his net pay for the month is .

Answers: 1

You know the right answer?

Mr. Samer and his wife are saving for their university education. The daughter just turned 10, and s...

Questions

History, 17.12.2020 23:00

Computers and Technology, 17.12.2020 23:00

Mathematics, 17.12.2020 23:00

English, 17.12.2020 23:00

Social Studies, 17.12.2020 23:00

Mathematics, 17.12.2020 23:00

History, 17.12.2020 23:00

Mathematics, 17.12.2020 23:00

Arts, 17.12.2020 23:00