Business, 16.05.2021 15:10 FireStorm6265

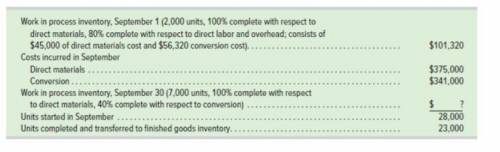

Compute each of the following.

1. The number of equivalent units for materials for the month.

2. The number of equivalent units for conversion for the month.

3. The variable cost per equivalent unit of materials for the month.

4. The variable cost per equivalent unit for conversion for the month.

5. The total variable cost of goods transferred out.

6. The total variable cost of ending work in process inventory.

Please explain your work in detail and provide in-text citations. At least 5 references are required

among which one should be the textbook as source of the data. Include the initial situation and

the initial assumptions in your answer.

*Please refer to the Grading Criteria for Professional Assignments in the University Policies

for specific guidelines and expectations.

Answers: 2

Another question on Business

Business, 21.06.2019 14:10

What other aspects of ecuadorian culture, other than its predominant religion and language, might affect that country’s culture?

Answers: 1

Business, 21.06.2019 20:30

Monetary policy in the united states is carried out primarily by which of the following agencies? a. the department of the treasury b. the small business association c. the federal reserve bank d. the u.s. mint 2b2t

Answers: 1

Business, 22.06.2019 05:00

Which of the following are considered needs? check all that apply

Answers: 1

Business, 22.06.2019 05:40

Grant, inc., acquired 30% of south co.’s voting stock for $200,000 on january 2, year 1, and did not elect the fair value option. the price equaled the carrying amount and the fair value of the interest purchased in south’s net assets. grant’s 30% interest in south gave grant the ability to exercise significant influence over south’s operating and financial policies. during year 1, south earned $80,000 and paid dividends of $50,000. south reported earnings of $100,000 for the 6 months ended june 30, year 2, and $200,000 for the year ended december 31, year 2. on july 1, year 2, grant sold half of its stock in south for $150,000 cash. south paid dividends of $60,000 on october 1, year 2. before income taxes, what amount should grant include in its year 1 income statement as a result of the investment?

Answers: 1

You know the right answer?

Compute each of the following.

1. The number of equivalent units for materials for the month.

Questions

Mathematics, 16.12.2020 16:40

Mathematics, 16.12.2020 16:40

Mathematics, 16.12.2020 16:40

Biology, 16.12.2020 16:40

Biology, 16.12.2020 16:40

Mathematics, 16.12.2020 16:40

English, 16.12.2020 16:40