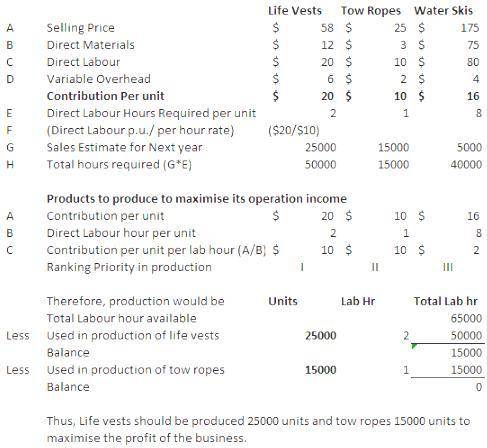

Gulf Breeze Corporation produces three products for water skiing enthusiasts: life vests, tow ropes, and water skis. Information relating to each product line is as follows. Life Vests Tow Ropes Water Skis Selling price $ 58 $ 25 $ 175 Direct materials 12 3 75 Direct labor 20 10 80 Variable overhead 6 2 4 Gulf Breeze pays its direct labor workers an average of $10 per hour. At full capacity, 65,000 direct labor hours are available per year. The marketing department has just released the following sales estimates for the upcoming year: life vests (25,000 units), tow ropes (15,000 units), and water skis (5,000 units). Based on these figures, demand for the current year is expected to exceed the company's direct labor capacity. a-1. Calculate the total hours required to meet demand of each products. a-2. What products should Gulf Breeze produce to maximize its operating income

Answers: 2

Another question on Business

Business, 21.06.2019 19:10

Maldonia has a comparative advantage in the production of , while lamponia has a comparative advantage in the production of . suppose that maldonia and lamponia specialize in the production of the goods in which each has a comparative advantage. after specialization, the two countries can produce a total of million pounds of lemons and million pounds of coffee.

Answers: 3

Business, 21.06.2019 19:40

Anew equipment has been proposed by engineers to increase the productivity of a certain manual welding operation. the investment cost is $25,000, and the equipment will have a market value of $5,000 at the end of a study period of five years. increased productivity attributable to the equipment will amount to $10,000 per year after operating costs have been subtracted from the revenue generated by the additional production. if marr is 10%, is investing in this equipment feasible? use annual worth method.

Answers: 3

Business, 22.06.2019 13:30

On january 2, well co. purchased 10% of rea, inc.’s outstanding common shares for $400,000, which equaled the carrying amount and the fair value of the interest purchased in rea’s net assets. well did not elect the fair value option. because well is the largest single shareholder in rea, and well’s officers are a majority on rea’s board of directors, well exercises significant influence over rea. rea reported net income of $500,000 for the year and paid dividends of $150,000. in its december 31 balance sheet, what amount should well report as investment in rea?

Answers: 3

Business, 22.06.2019 15:30

Calculate the required rate of return for climax inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. do not round your intermediate calculations.

Answers: 3

You know the right answer?

Gulf Breeze Corporation produces three products for water skiing enthusiasts: life vests, tow ropes,...

Questions

English, 08.04.2021 18:20

Chemistry, 08.04.2021 18:20

Mathematics, 08.04.2021 18:20

Social Studies, 08.04.2021 18:20

Physics, 08.04.2021 18:20

Mathematics, 08.04.2021 18:20

English, 08.04.2021 18:20

Mathematics, 08.04.2021 18:20

English, 08.04.2021 18:20