Business, 11.05.2021 22:40 ekerns2000paa19x

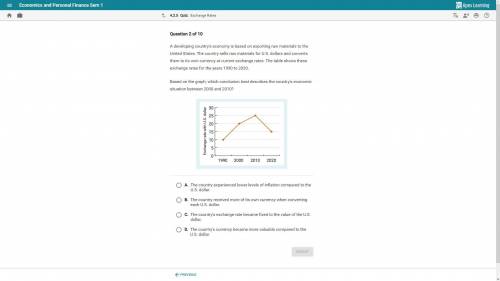

A developing country's economy is based on exporting raw materials to the United States. The country sells raw materials for U. S. dollars and converts them to its own currency at current exchange rates. The table shows these exchange rates for the years 1990 to 2020.

Based on the graph, which conclusion best describes the country's economic situation between 2000 and 2010?

A. The country experienced lower levels of inflation compared to the U. S

B. The country received more of its own currency when converting each U. S. dollar.

C. The country's exchange rate became fixed to the value of the U. S. dollar.

D. The country's currency became more valuable compared to the U. S. dollar.

Answers: 1

Another question on Business

Business, 21.06.2019 19:00

Ashare stock is a small piece of ownership in a company ture or false

Answers: 2

Business, 21.06.2019 22:30

Match the vocabulary word to the correct definition. 1. human resources department 2. job description 3. ethics 4. labor relations 5. occupational safety & health administration a. a detailed list of the functions and requirements for a position b. the exchange between the employer and employee c. principles that define appropriate conduct d. the government agency responsible for monitoring safety in the workplace e. the division of a business responsible for hiring, managing,maintaining, and firing the workforce

Answers: 1

Business, 22.06.2019 08:40

Examine the following book-value balance sheet for university products inc. the preferred stock currently sells for $30 per share and pays a dividend of $3 a share. the common stock sells for $16 per share and has a beta of 0.9. there are 2 million common shares outstanding. the market risk premium is 9%, the risk-free rate is 5%, and the firm’s tax rate is 40%. book-value balance sheet (figures in $ millions) assets liabilities and net worth cash and short-term securities $ 2.0 bonds, coupon = 6%, paid annually (maturity = 10 years, current yield to maturity = 8%) $ 5.0 accounts receivable 3.0 preferred stock (par value $15 per share) 3.0 inventories 7.0 common stock (par value $0.20) 0.4 plant and equipment 21.0 additional paid-in stockholders’ equity 13.6 retained earnings 11.0 total $ 33.0 total $ 33.0 a. what is the market debt-to-value ratio of the firm? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.) b. what is university’s wacc? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.)

Answers: 3

Business, 22.06.2019 10:50

Suppose that a firm is considering moving from a batch process to an assembly-line process to better meet evolving market needs. what concerns might the following functions have about this proposed process change: marketing, finance, human resources, accounting, and information systems?

Answers: 2

You know the right answer?

A developing country's economy is based on exporting raw materials to the United States. The country...

Questions

English, 06.05.2020 01:22

Mathematics, 06.05.2020 01:22

Mathematics, 06.05.2020 01:22

History, 06.05.2020 01:22

History, 06.05.2020 01:22

Biology, 06.05.2020 01:22

Social Studies, 06.05.2020 01:22

Mathematics, 06.05.2020 01:22

Health, 06.05.2020 01:22