Business, 13.04.2021 05:00 fdougie111

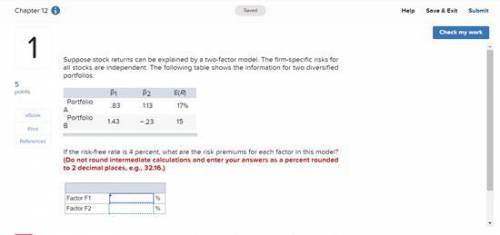

Suppose stock returns can be explained by a two-factor model. The firm-specific risks for all stocks are independent. The following table shows the information for two diversified portfolios:

β1 β2 E(R)

Portfolio A .83 1.13 17%

Portfolio B 1.43 −.23 15

If the risk-free rate is 4 percent, what are the risk premiums for each factor in this model? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e. g., 32.16.)

Looking for:

Factor F1 = _%

Factor F2 = _%

Answers: 1

Another question on Business

Business, 21.06.2019 21:00

Suppose an economist believes that the price level in the economy is directly related to the money supply, or the amount of money circulating in the economy. the economist proposes the following relationship: p=a x m - p=price level - m=money supply - a=a composite of other factors, including real gdp, that change very slowly over time. how might an economist gather empirical data to test the proposed relationship between money and the price level? an economist would persuade the federal reserve to change the money supply to various levels, and observe the resulting changes in the price level. unlike researchers in the hard sciences, economists cannot study complex relationships using data. economists do not usually develop theoretical models of the economy but only analyze summary statistics about the current state of the economy. an economist would look for data on past changes in the money supply, and note the resulting changes in the price level

Answers: 1

Business, 22.06.2019 13:50

Classify each of the following items as a public good, a private good, a natural monopoly good, or a common resource.(a) measles vaccinations (b) tuna in the pacific ocean (c) airline service in the united states (d) local storm-water system

Answers: 1

Business, 22.06.2019 16:00

In macroeconomics, to study the aggregate means to study blank

Answers: 1

Business, 22.06.2019 16:50

According to ceo heidi ganahl, camp bow wow requires a strong and consistent corporate culture to keep all local franchise owners "on the same page" and to follow a common template for the business and brand. this culture could become detrimental over time because: (a) strong consistent cultures are inflexible and incapable of adapting to environmental change (b) strong consistent cultures are too flexible and capable of adapting to environmental change (c) strong consistent cultures don’t perform well in any environment (d) the passing of time provides stability and predictability for businesses

Answers: 2

You know the right answer?

Suppose stock returns can be explained by a two-factor model. The firm-specific risks for all stocks...

Questions

Mathematics, 10.02.2021 23:00

Mathematics, 10.02.2021 23:00

English, 10.02.2021 23:00

Engineering, 10.02.2021 23:00

Social Studies, 10.02.2021 23:00

Arts, 10.02.2021 23:00

History, 10.02.2021 23:10

Health, 10.02.2021 23:10

Mathematics, 10.02.2021 23:10

Mathematics, 10.02.2021 23:10

Mathematics, 10.02.2021 23:10