PLEASE HELP

Question 6 of 20

Lisa decided to take a walk one Sunday afternoon. During h...

Business, 08.04.2021 18:40 cyanezc1313

PLEASE HELP

Question 6 of 20

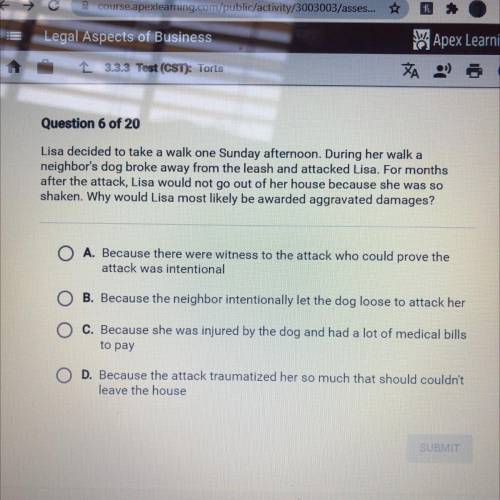

Lisa decided to take a walk one Sunday afternoon. During her walk a

neighbor's dog broke away from the leash and attacked Lisa. For months

after the attack, Lisa would not go out of her house because she was so

shaken. Why would Lisa most likely be awarded aggravated damages?

A. Because there were witness to the attack who could prove the

attack was intentional

B. Because the neighbor intentionally let the dog loose to attack her

C. Because she was injured by the dog and had a lot of medical bills

to pay

D. Because the attack traumatized her so much that should couldn't

leave the house

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

The county collector of suncoast county is responsible for collecting all property taxes levied by funds and governments within the boundaries of the county. to reimburse the county for estimated administrative expenses of operating the tax agency fund, the agency fund deducts 1.5 percent from the collections for the town, the school district, and the other towns. the total amount deducted is added to the collections for the county and remitted to the suncoast county general fund.the following events occurred in 2017: 1. current-year tax levies to be collected by the agency were: county general fund $ 10,333,000 town of bayshore general fund 4,840,000 suncoast county consolidated school district 6,550,000 other towns 3,120,000 total $ 24,843,000 2. $13,700,000 of current taxes was collected during the first half of 2017.3. liabilities to all funds and governments as a result of the first half-year collections were recorded. (a schedule of amounts collected for each participant, showing the amount withheld for the county general fund and net amounts due the participants, is recommended for determining amounts to be recorded for this transaction.)4. all cash in the tax agency fund was distributed.requireda. prepare journal entries for each of the foregoing transactions that affected the tax agency fund. (if no entry is required for a transaction/event, select "no journal entry required" in the first account field. do not round intermediate calculations. round your answers to the nearest whole dollar amount.)1. record the current-year tax levies to be collected by the agency.2.record the current taxes collected during the first half of 2017.3.record the liabilities due to all funds and governments at the end of first half-year.4. record the distribution of all cash in the tax agency fundb. prepare journal entries for each of the foregoing entries that affected the town of bayshore general fund. begin with the tax levy entry, assuming 2 percent of the gross levy will be uncollectible. (if no entry is required for a transaction/event, select "no journal entry required" in the first account field. do not round intermediate calculations. round your answers to the nearest whole dollar amount.)1.record the revenues receivable and uncollectible.2. record the taxes collected

Answers: 3

Business, 21.06.2019 21:20

According to the u.s. census bureau (), the median household income in the united states was $23,618 in 1985, $34,076 in 1995, $46,326 in 2005, and $57,230 in 2015. in purchasing power terms, how did family income compare in each of those four years? you will need to know that the cpi (multiplied by 100, 1982–1984 = 100) was 107.6 in 1985, 152.4 in 1995, 195.3 in 2005, and 237.0 in 2015

Answers: 3

Business, 21.06.2019 23:20

Which feature transfers a slide show into a word-processing document?

Answers: 2

Business, 22.06.2019 01:00

Awidower devised his fee simple interest in his residence as follows: “to my daughter for life, then to my oldest grandchild who survives her.” at the time of the widower’s death, he was survived by his only two children, a son and a daughter, and by one grandchild, his daughter’s son. a short time later, the daughter together with her son entered into a contract to sell the residence in fee simple to a buyer. the applicable jurisdiction continues to follow the common law rule against perpetuities, but has abrogated the rule in shelley’s case. at the closing, the buyer refused to purchase the residence. can the sellers compel the buyer to do so?

Answers: 2

You know the right answer?

Questions

English, 14.01.2021 22:20

Mathematics, 14.01.2021 22:20

Mathematics, 14.01.2021 22:30

Mathematics, 14.01.2021 22:30

Mathematics, 14.01.2021 22:30

History, 14.01.2021 22:30

Mathematics, 14.01.2021 22:30

Business, 14.01.2021 22:30