Business, 25.03.2021 04:30 trinity0929

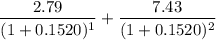

The next three annual dividends paid by XYZ stock are expected to be $2.79 in one year, $7.43 in two years, and $3.05 in three years. The price of the stock is expected to be $54.78 in two years. The expected annual return for the stock is 15.20 percent. What is the current price of one share of XYZ stock?

a. $49.83 (+ or - $0.05).

b. $51.82 (+ or - $0.05).

c. $46.38 (+ or - $0.05).

d. $49.30 (+ or - $0.05).

e. none of the above is within $0.05 of the correct answer.

Answers: 1

Another question on Business

Business, 21.06.2019 21:00

Concrete consulting co. has the following accounts in its ledger: cash; accounts receivable; supplies; office equipment; accounts payable; jason payne, capital; jason payne, drawing; fees earned; rent expense; advertising expense; utilities expense; miscellaneous expense. transactions oct. 1 paid rent for the month, $3,600. 3 paid advertising expense, $1,200. 5 paid cash for supplies, $750. 6 purchased office equipment on account, $8,000. 10 received cash from customers on account, $14,800. 15 paid creditors on account, $7,110. 27 paid cash for miscellaneous expenses, $400. 30 paid telephone bill (utility expense) for the month, $250. 31 fees earned and billed to customers for the month, $33,100. 31 paid electricity bill (utility expense) for the month, $1,050. 31 withdrew cash for personal use, $2,500. journalize the following selected transactions for october 2019 in a two-column journal. refer to the chart of accounts for exact wording of account titles

Answers: 2

Business, 22.06.2019 04:00

The simple interest in a loan of $200 at 10 percent interest per year is

Answers: 2

Business, 22.06.2019 06:30

73. calculate the weighted average cost of capital (wacc) based on the following information: the equity multiplier is 1.66; the interest rate on debt is 13%; the required return to equity holders is 22%; and the tax rate is 35%. (a) 15.6% (b) 16.0% (c) 15.0% (d) 16.6% (e) none of the above

Answers: 2

Business, 23.06.2019 07:00

To manage your money, you should -create a financial plan -organize your financial documents -spend wisely -create a budget -manage your risks -spend more than you make -learn about services offered at your bank

Answers: 3

You know the right answer?

The next three annual dividends paid by XYZ stock are expected to be $2.79 in one year, $7.43 in two...

Questions

Mathematics, 09.01.2020 08:31

Mathematics, 09.01.2020 08:31

Health, 09.01.2020 08:31

Mathematics, 09.01.2020 08:31

Mathematics, 09.01.2020 08:31

Mathematics, 09.01.2020 08:31

English, 09.01.2020 08:31

Mathematics, 09.01.2020 08:31

Physics, 09.01.2020 08:31

Mathematics, 09.01.2020 08:31

Mathematics, 09.01.2020 08:31

Biology, 09.01.2020 08:31

Mathematics, 09.01.2020 08:31

Mathematics, 09.01.2020 08:31