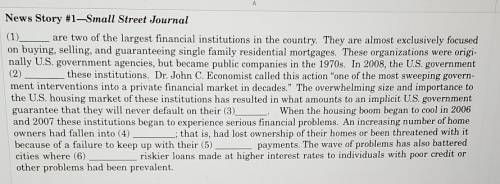

These are the choices fill in the blanks.

asset backed security bank run

credit default swap....

Business, 23.03.2021 01:20 dolphinkina35

These are the choices fill in the blanks.

asset backed security bank run

credit default swap. capital

bond. credit

common stock. credit crunch

mortgage-backed securities. debt

mutual fund. default

option. equity

futures contract. foreclosure

subprime mortgage. leverage

central bank. liquidity

commercial bank. liquidity risk

hedge fund. moral hazard

investment bank. mortgage

fannie mae/ freddie mac. nationalization

federal deposit insurance corporation regulation

federal reserve system. return

private equity fund

risk

securitization

Answers: 2

Another question on Business

Business, 21.06.2019 20:30

Which of the following best describes the purpose of raising and lowering the required reserve ratio? a. to make sure that government spending does not result in either a surplus or deficit. b. to stimulate economic growth by making it less expensive for producers to get loans. c. to manage the economy by increasing or decreasing the amount of loans being made. d. to regulate the activity of private banks to assure an equitable distribution of wealth. 2b2t

Answers: 3

Business, 23.06.2019 02:30

Organizations typically rely on schedules, such as hourly wages and annual reviews and raises.

Answers: 2

Business, 23.06.2019 04:00

Match the different taxes to the levels at which these taxes are levied on consumers and businesses national level/ national and local levels 1.sales tax 2.income tax 3.payroll tax 4.social security tax 4.property tax

Answers: 1

Business, 23.06.2019 15:10

Ansys license manager error capability cad interface parasolid does not exist in the ansys licensing pool non of the products enabling this capability are available in the specified license path

Answers: 2

You know the right answer?

Questions

Physics, 31.08.2019 19:30

English, 31.08.2019 19:30

Mathematics, 31.08.2019 19:30

English, 31.08.2019 19:30

Biology, 31.08.2019 19:30

Geography, 31.08.2019 19:30

Mathematics, 31.08.2019 19:30