. Has a high paying job and has determined he could afford up to $2500 per month

Business, 20.03.2021 01:00 michellemonchez103

.

BRYCE:

. Has a high paying job and has determined he could afford up to $2500 per month

Wants a sweet home to reward all his hard work; his dream home costs $550,000

Has been sloppy in the past with his bill pay, leading to a credit score of 650, so the best rate he can get is

4.69% for 30 years

Is willing to contribute $50,000 to his down payment

11. How much, per month, is Bryce short on

mortgage payments for his dream home?

12. If he increased his down payment from $50,000 to $75,000, could Bryce get his monthly payments below

$2500?

a. Using this strategy, how much total interest would he pay over the course of the loan?

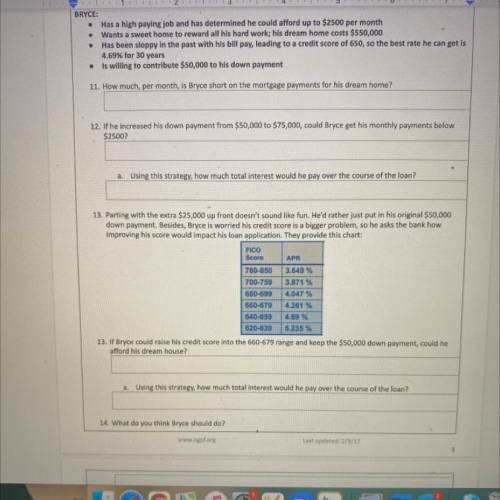

13. Parting with the extra $25,000 up front doesn't sound like fun. He'd rather just put in his original $50,000

down payment. Besides, Bryce is worried his credit score is a bigger problem, so he asks the bank how

improving his score would impact his loan application. They provide this chart:

FICO

Score APR

760-850 3.649 %

700-759 3.871 %

680-699 4.047 %

660-679 4.261 %

640-659 4.69%

620-639 5.235%

13. If Bryce could raise his Credit score into the 660 -679 range and keep the $50,000 down payment could he afford his dream house?

A. Using this Shatagee how much total interest would he pay over the course of the loan

14. what do you think I should do?

L

Answers: 3

Another question on Business

Business, 22.06.2019 00:00

Which of the following is a disadvantage to choosing a sole proprietorship business structure? question 9 options: the owner has personal responsibility for the company's liabilities. the owner has to share the profits with partners. the owner is still liable for personal debts. the owner has to report to shareholders.

Answers: 1

Business, 22.06.2019 12:30

Suppose a holiday inn hotel has annual fixed costs applicable to its rooms of $1.2 million for its 300-room hotel, average daily room rents of $50, and average variable costs of $10 for each room rented. it operates 365 days per year. the amount of operating income on rooms, assuming an occupancy* rate of 80% for the year, that will be generated for the entire year is *occupancy = % of rooms rented

Answers: 1

Business, 22.06.2019 14:20

Your uncle borrows $53,000 from the bank at 11 percent interest over the nine-year life of the loan. use appendix d for an approximate answer but calculate your final answer using the formula and financial calculator methods. what equal annual payments must be made to discharge the loan, plus pay the bank its required rate of interest

Answers: 1

Business, 22.06.2019 16:00

If the family’s net monthly income is 7,800 what percent of the income is spent on food clothing and housing?

Answers: 3

You know the right answer?

.

BRYCE:

. Has a high paying job and has determined he could afford up to $2500 per month

. Has a high paying job and has determined he could afford up to $2500 per month

Questions

English, 20.10.2020 22:01

Mathematics, 20.10.2020 22:01

Mathematics, 20.10.2020 22:01

Biology, 20.10.2020 22:01

Mathematics, 20.10.2020 22:01

Chemistry, 20.10.2020 22:01

Biology, 20.10.2020 22:01

Mathematics, 20.10.2020 22:01

Physics, 20.10.2020 22:01

History, 20.10.2020 22:01

Mathematics, 20.10.2020 22:01

Health, 20.10.2020 22:01