Business, 19.03.2021 16:10 ddddre4460

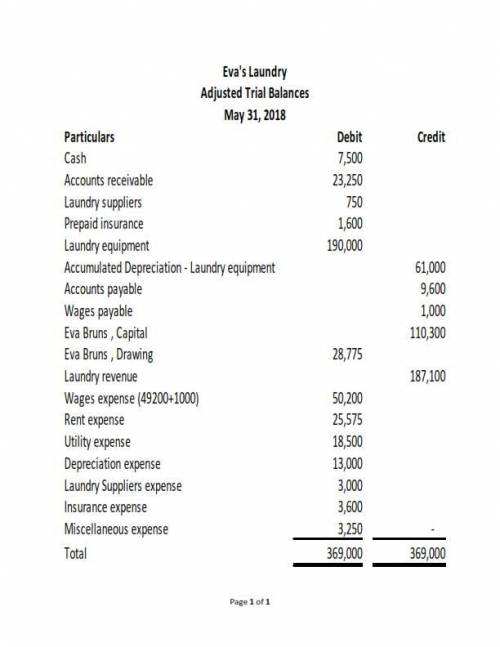

The accountant for Eva's Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted trial balance and the amounts of the adjustments are correct. Identify the errors in the accountant's adjusting entries, assuming that none of the accounts were affected by more than one adjusting entry.

Eva's Laundry

Trial Balances

May 31, 2018

Unadjusted Adjusted

Debit Balances Credit Balances Debit Balances Credit Balances

Cash . 7,500 7,500

Accounts Receivable . 18,250 23,250

Laundry Supplies 3,750 6,750

Prepaid Insurance* 5,200 1,600

Laundry Equipment . . 190,000 177,000

Accumulated Depreciation—Laundry

48,000 48,000

Accounts Payable 9,600 9,600

Wages Payable 1,000

Capital Stock . . 35,000 35,000

Retained Earnings 75,300 75,300

Dividends 28,775

Laundry Revenue 182,100 182,100

Wages Expense 49,200 49,200

Rent Expense . . 25,575 25,575

Utilities Expense . 18,500 18,500

Depreciation Expense 13,000

Laundry Supplies Expense 3,000

Insurance Expense 600

Miscellaneous Expense .3,250 3,250

350,000 350,000 358,000 351,000

Answers: 1

Another question on Business

Business, 22.06.2019 02:10

Materials purchases (on credit). direct materials used in production. direct labor paid and assigned to work in process inventory. indirect labor paid and assigned to factory overhead. overhead costs applied to work in process inventory. actual overhead costs incurred, including indirect materials. (factory rent and utilities are paid in cash.) transfer of jobs 306 and 307 to finished goods inventory. cost of goods sold for job 306. revenue from the sale of job 306. assignment of any underapplied or overapplied overhead to the cost of goods sold account. (the amount is not material.) 2. prepare journal entries for the month of april to record the above transactions.

Answers: 1

Business, 22.06.2019 07:40

Xyz corporation has provided the following data concerning manufacturing overhead for july: actual manufacturing overhead incurred $ 69,000 manufacturing overhead applied to work in process $ 79,000 the company's cost of goods sold was $243,000 prior to closing out its manufacturing overhead account. the company closes out its manufacturing overhead account to cost of goods sold. which of the following statements is true? multiple choice manufacturing overhead was overapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $253,000 manufacturing overhead was underapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $233,000 manufacturing overhead was underapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $253,000 manufacturing overhead was overapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $233,000

Answers: 1

Business, 22.06.2019 12:20

Selected transactions of the carolina company are listed below. classify each transaction as either an operating activity, an investing activity, a financing activity, or a noncash activity. 1. common stock is sold for cash above par value. 2. bonds payable are issued for cash at a discount

Answers: 2

Business, 22.06.2019 14:30

The state in which the manufacturing company you work for is located regulates the presence of a particular substance in the environment to concentrations ≤ x. recently-released, reliable research endorsed by the responsible federal agency conclusively demonstrates that the substance poses no risks at concentrations up to 5x. your company has asked you to consider designing a new process with a waste discharge stream containing up to 2x of the substance. based on the stated conditions, describe this possible.

Answers: 2

You know the right answer?

The accountant for Eva's Laundry prepared the following unadjusted and adjusted trial balances. Assu...

Questions

History, 05.06.2021 23:50

Mathematics, 05.06.2021 23:50

Mathematics, 05.06.2021 23:50

Spanish, 05.06.2021 23:50

Medicine, 05.06.2021 23:50