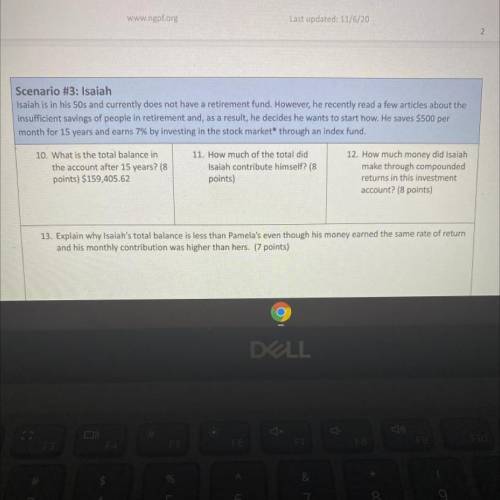

Scenario #3: Isaiah

Isaiah is in his 50s and currently does not have a retirement fund. However, he recently read a few articles about the

insufficient savings of people in retirement and, as a result, he decides he wants to start now. He saves $500 per

month for 15 years and earns 7% by investing in the stock market* through an index fund.

10. What is the total balance in

the account after 15 years? (8

points) $159,405.62

11. How much of the total did

Isaiah contribute himself? (8

points)

12. How much money did Isaiah

make through compounded

returns in this investment

account? (8 points)

13. Explain why Isaiah's total balance is less than Pamela's even though his money earned the same rate of return

and his monthly contribution was higher than hers. (7 points)

Answers: 3

Another question on Business

Business, 22.06.2019 19:00

The following are budgeted data: january february march sales in units 16,200 22,400 19,200 production in units 19,200 20,200 18,700 one pound of material is required for each finished unit. the inventory of materials at the end of each month should equal 20% of the following month's production needs. purchases of raw materials for february would be budgeted to be:

Answers: 3

Business, 22.06.2019 20:00

Question 6 of 102 pointswhich situation shows a constant rate of change? oa. the number of tickets sold compared with the number of minutesbefore a football gameob. the height of a bird over timeoc. the cost of a bunch of grapes compared with its weightod. the outside temperature compared with the time of day

Answers: 1

Business, 22.06.2019 20:00

Double corporation acquired all of the common stock of simple company for

Answers: 1

Business, 22.06.2019 20:20

You are the cfo of a u.s. firm whose wholly owned subsidiary in mexico manufactures component parts for your u.s. assembly operations. the subsidiary has been financed by bank borrowings in the united states. one of your analysts told you that the mexican peso is expected to depreciate by 30 percent against the dollar on the foreign exchange markets over the next year. what actions, if any, should you take

Answers: 2

You know the right answer?

Scenario #3: Isaiah

Isaiah is in his 50s and currently does not have a retirement fund. However, he...

Questions

Physics, 10.07.2019 18:00

History, 10.07.2019 18:00

Mathematics, 10.07.2019 18:00

Mathematics, 10.07.2019 18:00

Mathematics, 10.07.2019 18:00

English, 10.07.2019 18:00

History, 10.07.2019 18:00

Mathematics, 10.07.2019 18:00

Biology, 10.07.2019 18:00

Mathematics, 10.07.2019 18:00

Mathematics, 10.07.2019 18:00