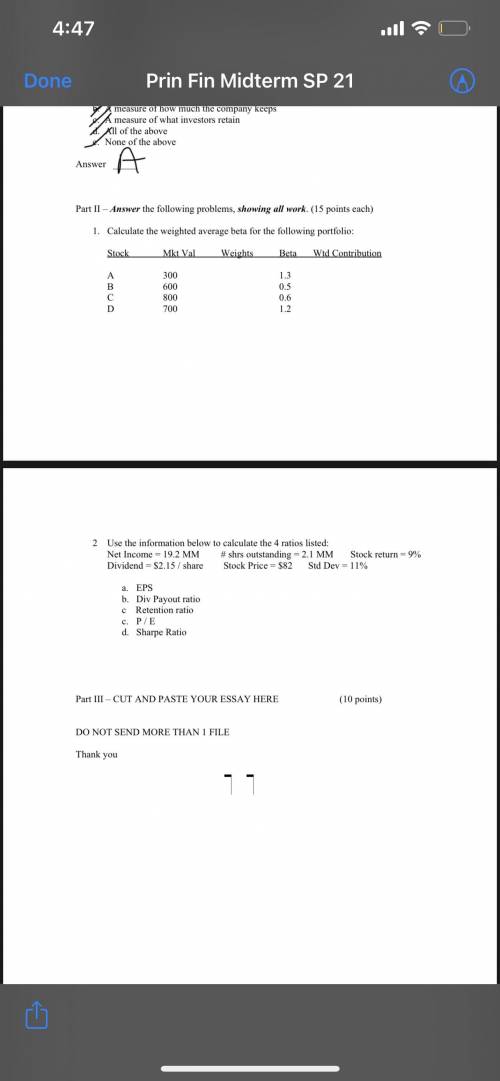

Calculate the weighted average beta for the following portfolio:

Stock Mkt Val

A 300

B...

Business, 18.03.2021 02:00 quinnmal023

Calculate the weighted average beta for the following portfolio:

Stock Mkt Val

A 300

B 600

C 800

D 700

Weights

Beta Wtd Contribution

1.3 0.5 0.6 1.2

2 Use the information below to calculate the 4 ratios listed:

Net Income = 19.2 MM Dividend = $2.15 / share

a. EPS

b. Div Payout ratio c Retention ratio c. P/E

d. Sharpe Ratio

# shrs outstanding = 2.1 MM Stock return = 9%

Answers: 3

Another question on Business

Business, 22.06.2019 02:50

Wren pork company uses the value basis of allocating joint costs in its production of pork products. relevant information for the current period follows: product pounds price/lb. loin chops 3,000 $ 5.00 ground 10,000 2.00 ribs 4,000 4.75 bacon 6,000 3.50 the total joint cost for the current period was $43,000. how much of this cost should wren pork allocate to loin chops?

Answers: 1

Business, 22.06.2019 05:00

Ajewelry direct sales company pays its consultants based on recruiting new members. question 1 options: the company is running a pyramid scheme, which is illegal. the company is running a pyramid scheme, which is legal. the company has implemented a legal and ethical plan for growth. the company uses this method of compensation to reduce the fee for the product sample kit.

Answers: 3

Business, 22.06.2019 06:30

73. calculate the weighted average cost of capital (wacc) based on the following information: the equity multiplier is 1.66; the interest rate on debt is 13%; the required return to equity holders is 22%; and the tax rate is 35%. (a) 15.6% (b) 16.0% (c) 15.0% (d) 16.6% (e) none of the above

Answers: 2

Business, 22.06.2019 11:00

While on vacation in las vegas jennifer, who is from utah, wins a progressive jackpot playing cards worth $15,875 at the casino royale. what implication does she encounter when she goes to collect her prize?

Answers: 1

You know the right answer?

Questions

Mathematics, 05.02.2021 01:30

History, 05.02.2021 01:30

Advanced Placement (AP), 05.02.2021 01:30

Computers and Technology, 05.02.2021 01:30

Mathematics, 05.02.2021 01:30

Mathematics, 05.02.2021 01:30

Mathematics, 05.02.2021 01:30

Mathematics, 05.02.2021 01:30

Mathematics, 05.02.2021 01:30