Business, 09.03.2021 01:20 bearminar2156

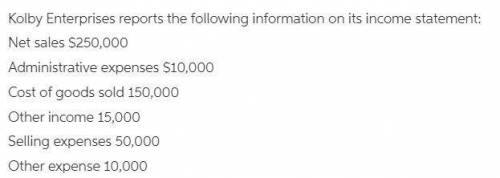

Profitability Analysis Kolby Enterprises reports the following information on its income statement: L04 Net sales . . $250,000 150,000 50,000 Administrative expenses . . $10,000 15,000 10,000 Cost of goods sold .. . . .. . . .. . . Other income .. . . .. . . .. . .. . . . Selling expenses . Other expense . Required Calculate Kolby 's gross profit percentage and return on sales ratio. Explain what each ratio tells us about Kolby 's performance. Kolby is planning to add a new product and expects net sales to be $45,000 and cost of goods to be $38,000. No other income or expenses are expected to change. How will this affect Kolby 's gross profit percentage and return on sales ratio

Answers: 2

Another question on Business

Business, 21.06.2019 22:50

Tara incorporates her sole proprietorship, transferring it to newly formed black corporation. the assets transferred have an adjusted basis of $240,000 and a fair market value of $300,000. also transferred was $10,000 in liabilities, $1,000 of which was personal and the balance of $9,000 being business related. in return for these transfers, tara receives all of the stock in black corporation. a. black corporation has a basis of $241,000 in the property. b. black corporation has a basis of $240,000 in the property. c. tara’s basis in the black corporation stock is $241,000. d. tara’s basis in the black corporation stock is $249,000. e. none of the above.

Answers: 1

Business, 23.06.2019 09:00

You tour a company and notice that employees all seem to have a common goal and understanding of procedures. what would be the contributing factor for this?

Answers: 3

Business, 23.06.2019 15:00

Aplant manager is considering buying additional stamping machines to accommodate increasing demand. the alternatives are to buy 1 machine, 2 machines, or 3 machines. the profits realized under each alternative are a function of whether their bid for a recent defense contract is accepted or not. the payoff table below illustrates the profits realized (in $000's) based on the different scenarios faced by the manager. alternative bid accepted bid rejected buy 1 machine $10 $5 buy 2 machines $30 $4 buy 3 machines $40 $2 refer to the information above. assume that based on historical bids with the defense contractor, the plant manager believes that there is a 65% chance that the bid will be accepted and a 35% chance that the bid will be rejected. what is the expected value under perfect information (evpi)?

Answers: 1

Business, 23.06.2019 15:30

When filling out paperwork after you've been hired, you must have a: a. hiring sheetb. driver's licensec. social security numberd. copy of your transcript

Answers: 1

You know the right answer?

Profitability Analysis Kolby Enterprises reports the following information on its income statement:...

Questions

Mathematics, 29.09.2020 20:01

Mathematics, 29.09.2020 20:01

Mathematics, 29.09.2020 20:01

Mathematics, 29.09.2020 20:01

Mathematics, 29.09.2020 20:01