Business, 08.03.2021 20:00 davelopez979

Omni Advisors, an international pension fund manager, uses the concepts of purchasingpower parity (PPP) and uncovered interest parity/international Fisher effect (IFE) toforecast spot exchange rates. Omni gathers the financial information as follows:(Note: The rand (ZAR) is the South African currency. USD refers to the U. S. dollar. The base year denotes the beginning of the period.)

Base price level (any country) 100

Current U. S. price level 105

Current South African price level 111

Base rand spot exchange rate $0.175

Current rand spot exchange rate $0.158

Expected annual U. S. inflation 7%

Expected annual South African inflation 5%

Expected U. S. one-year interest rate 10%

Expected South African one-year interest rate 8%

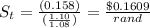

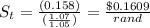

(a) According to PPP, what should the current ZAR spot rate in USD (USD/ZAR)be?

(b) According to PPP, is the U. S. dollar expected to appreciate or depreciate relativeto the rand over the year? Why?

(c) According to the UIP/IFE is the U. S. dollar expected to appreciate or depreciaterelative to the rand over the year? Why?

(d) Compare your answer in b) and c). Are you surprised? Why?

Answers: 3

Another question on Business

Business, 22.06.2019 19:30

Each row in a database is a set of unique information called a(n) table. record. object. field.

Answers: 3

Business, 23.06.2019 01:50

Exhibit 34-1 country a country b good x 90 60 30 0 good ygood x good y 0 30 60 90 30 20 10 20 40 60 refer to exhibit 34-1. considering the data, which of the following term to? a. 1 unit of y for 1 unit of x b. 1 unit of y for 0.75 units of x c. 1 unit of y for 0.25 units of x d. 1 unit of y for 1.50 units of x e. all of the above s of trade would both countries agree 8. it -

Answers: 2

Business, 23.06.2019 01:50

Consider a firm with a contract to sell an asset for $149,000 four years from now. the asset costs $85,000 to produce today. a. given a relevant discount rate of 14 percent per year, calculate the profit the firm will make on this asset. (a loss should be indicated by a minus sign. do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. at what rate does the firm just break even?

Answers: 3

You know the right answer?

Omni Advisors, an international pension fund manager, uses the concepts of purchasingpower parity (P...

Questions

Mathematics, 03.02.2021 19:40

Mathematics, 03.02.2021 19:40

Chemistry, 03.02.2021 19:40

Business, 03.02.2021 19:40

Chemistry, 03.02.2021 19:40

Mathematics, 03.02.2021 19:40

Mathematics, 03.02.2021 19:40

English, 03.02.2021 19:40

Social Studies, 03.02.2021 19:40

Mathematics, 03.02.2021 19:40

Mathematics, 03.02.2021 19:40

whereas St will be the current level currencies,

whereas St will be the current level currencies,  was its base point currency.

was its base point currency.  would be in the home nation the market price

would be in the home nation the market price  in a different nation was its price standard.

in a different nation was its price standard.

= inflation rate in the home country

= inflation rate in the home country = inflation rate in a foreign country

= inflation rate in a foreign country

= Homeland interest rate

= Homeland interest rate = foreign country interest rate

= foreign country interest rate