Business, 08.03.2021 20:00 mathhelppls14

Mid-South Auto Leasing leases vehicles to consumers. The attraction to customers is that the company can offer competitive prices due to volume buying and requires an interest rate implicit in the lease that is one percent below alternate methods of financing. On September 30, 2021, the company leased a delivery truck to a local florist, Anything Grows.

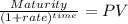

The lease agreement specified quarterly payments of $3,000 beginning September 30, 2019, the inception of the lease, and each quarter (December 31, March 31, and June 30) through June 30, 2021 (three-year lease term). The florist had the option to purchase the truck on September 29, 2011, for $6,000 when it was expected to have a residual value of $10,000.

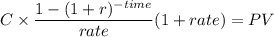

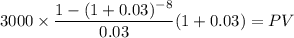

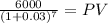

The estimated useful life of the truck is four years. Mid-South Auto Leasing's quarterly interest rate for determining payments was 3% (approximately 12% annually). Mid-South paid $25,000 for the truck. Both companies use straight-line depreciation. Anything Grows' incremental interest rate is 12%.

Required:

a. Calculate the amount of dealer's profit that Mid-South would recognize in this sales-type lease. (Be careful to note that, although payments occur on the last calendar day of each quarter, since the first payment was at the inception of the lease, payments represent an annuity due.)

b. Prepare the appropriate entries for Anything Grows and Mid-South on September 30, 2019.

c. Prepare an amortization schedule(s) describing the pattern of interest expense for Anything Grows and interest revenue for Mid-South Auto Leasing over the lease term.

d. Prepare the appropriate entries for Anything Grows and Mid-South Auto Leasing on December 31, 2019.

e. Prepare the appropriate entries for Anything Grows and Mid-South on September 29, 2019, assuming the bargain purchase option was exercised on that date.

Answers: 2

Another question on Business

Business, 21.06.2019 21:00

Resources and capabilities, such as interpersonal relations among managers and a firm's culture, that may be costly to imitate because they are beyond the ability of firms to systematically manage and influence are referred to asanswers: socially complex.causally ambiguous.path dependent.the result of unique historical conditions.

Answers: 3

Business, 21.06.2019 23:00

James has set the goal of achieving all "a"s during this year of school.which term best describes this goal

Answers: 2

Business, 23.06.2019 17:00

Why do you think researchers chose to begin with cigarette smokers opposed to other types of addiction ?

Answers: 2

You know the right answer?

Mid-South Auto Leasing leases vehicles to consumers. The attraction to customers is that the company...

Questions

Mathematics, 16.10.2019 01:30

History, 16.10.2019 01:30

Mathematics, 16.10.2019 01:30

World Languages, 16.10.2019 01:30

Geography, 16.10.2019 01:30

Biology, 16.10.2019 01:30

Mathematics, 16.10.2019 01:30

Health, 16.10.2019 01:30

Mathematics, 16.10.2019 01:30

Mathematics, 16.10.2019 01:30

Social Studies, 16.10.2019 01:30

Social Studies, 16.10.2019 01:30

Mathematics, 16.10.2019 01:30

![\left[\begin{array}{cccccc}$Time&$Beg&$Cuota&$Interes&$Amort&$Ending\\0&26569.4&3000&&3000&23569.4\\1&23569.4&3000&707.08&2292.92&21276.48\\2&21276.48&3000&638.29&2361.71&18914.77\\3&18914.77&3000&567.44&2432.56&16482.21\\4&16482.21&3000&494.47&2505.53&13976.68\\5&13976.68&3000&419.3&2580.7&11395.98\\6&11395.98&3000&341.88&2658.12&8737.86\\7&8737.86&9000&262.14&8737.86&0\end{array}\right]](/tpl/images/1177/7125/47b8d.png)