PLSSS PLSS IM BEGGING YOU GUYS HELP ME.

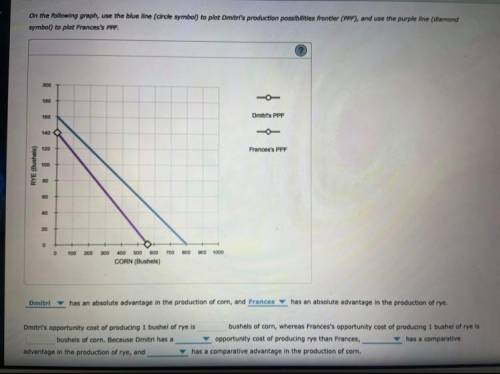

___ (Frances/Dimitri) has an absolute advantage in the production of corn, and ___ (Frances/Dimitri) has an absolute advantage in the production of rye.

Dmitri's opportunity cost of producing 1 bushel of rye is ___ bushels of corn, whereas Frances's opportunity cost of producing 1 bushel of rye is __ bushels of corn. Because Dmitri has a ___(higher/lower) opportunity cost of producing rye than Frances,_(Frances/Dimitri) has a comparative advantage in the production of rye, and ___ (FRANCES/DIMITRI) has a comparative advantage in the production of corn.

Answers: 3

Another question on Business

Business, 21.06.2019 16:10

Baldwin has negotiated a new labor contract for the next round that will affect the cost for their product bold. labor costs will go from $7.91 to $8.41 per unit. in addition, their material costs have fallen from $13.66 to $12.66. assume all period costs as reported on baldwin's income statement remain the same. if baldwin were to pass on half the new costs of labor and half the savings in materials to customers by adjusting the price of their product, how many units of product bold would need to be sold next round to break even on the product?

Answers: 2

Business, 21.06.2019 18:00

Abc company currently pays a dividend of $2.15 per share, d0=2.15. it is estimated that the company’s dividend will grow at a rate of 30 percent per year for the next 3 years, then the dividend will grow at a constant rate of 7 percent thereafter. the market rate of return is 9 percent. what would you estimate is the stock’s current price?

Answers: 3

Business, 22.06.2019 02:30

Acompany factory is considered which type of resource a.land b.physical capital c.labor d.human capital

Answers: 2

Business, 22.06.2019 09:40

Alpha industries is considering a project with an initial cost of $8 million. the project will produce cash inflows of $1.49 million per year for 8 years. the project has the same risk as the firm. the firm has a pretax cost of debt of 5.61 percent and a cost of equity of 11.27 percent. the debt–equity ratio is .60 and the tax rate is 35 percent. what is the net present value of the project?

Answers: 1

You know the right answer?

PLSSS PLSS IM BEGGING YOU GUYS HELP ME.

___ (Frances/Dimitri) has an absolute advantage in the prod...

Questions

Mathematics, 26.07.2019 04:00

Mathematics, 26.07.2019 04:00

History, 26.07.2019 04:00

English, 26.07.2019 04:00

Mathematics, 26.07.2019 04:00

Spanish, 26.07.2019 04:00

Social Studies, 26.07.2019 04:00

History, 26.07.2019 04:00

History, 26.07.2019 04:00

Health, 26.07.2019 04:00

History, 26.07.2019 04:00