Business, 24.02.2021 03:10 steven2669

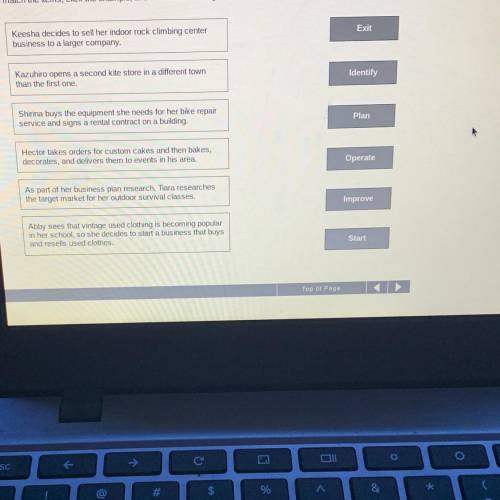

To match the items, click the example, and then click the stage.

Keesha decides to sell her indoor rock climbing center

business to a larger company.

Exit

Kazuhiro opens a second kite store in a different town

than the first one.

Identify

Shirina buys the equipment she needs for her bike repair

service and signs a rental contract on a building.

Plan

Hector takes orders for custom cakes and then bakes,

decorates, and delivers them to events in his area.

Operate

As part of her business plan research, Tiara researches

the target market for her outdoor survival classes.

Improve

Abby sees that vintage used clothing is becoming popular

in her school, so she decides to start a business that buys

and resells used clothes.

Start

Answers: 2

Another question on Business

Business, 21.06.2019 23:30

Highland company produces a lightweight backpack that is popular with college students. standard variable costs relating to a single backpack are given below

Answers: 1

Business, 22.06.2019 01:30

How will firms solve the problem of an economic surplus a. decrease prices to the market equilibrium price b. decrease prices so they are below the market equilibrium price c.increase prices

Answers: 3

Business, 22.06.2019 06:00

List three careers that require knowledge of science. list three careers that require the use of of math. list three careers that require the use of foreign language. list three careers that require the use of good writing skills. list three careers that require the use of good computer skills.

Answers: 3

Business, 22.06.2019 06:20

James albemarle created a trust fund at the beginning of 2016. the income from this fund will go to his son edward. when edward reaches the age of 25, the principal of the fund will be conveyed to united charities of cleveland. mr. albemarle specified that 75 percent of trustee fees are to be paid from principal. terry jones, cpa, is the trustee. james albemarle transferred cash of $500,000, stocks worth $400,000, and rental property valued at $250,000 to the trustee of this fund. immediately invested cash of $360,000 in bonds issued by the u.s. government. commissions of $7,900 are paid on this transaction. incurred permanent repairs of $9,000 so that the property can be rented. payment is made immediately. received dividends of $8,000. of this amount, $3,000 had been declared prior to the creation of the trust fund. paid insurance expense of $4,000 on the rental property. received rental income of $10,000. paid $8,000 from the trust for trustee services rendered. conveyed cash of $7,000 to edward albemarle.

Answers: 2

You know the right answer?

To match the items, click the example, and then click the stage.

Keesha decides to sell her indoor...

Questions

History, 19.11.2019 03:31

Mathematics, 19.11.2019 03:31

Mathematics, 19.11.2019 03:31

Physics, 19.11.2019 03:31

Mathematics, 19.11.2019 03:31

Biology, 19.11.2019 03:31

Mathematics, 19.11.2019 03:31

Biology, 19.11.2019 03:31

Mathematics, 19.11.2019 03:31

Mathematics, 19.11.2019 03:31

Mathematics, 19.11.2019 03:31