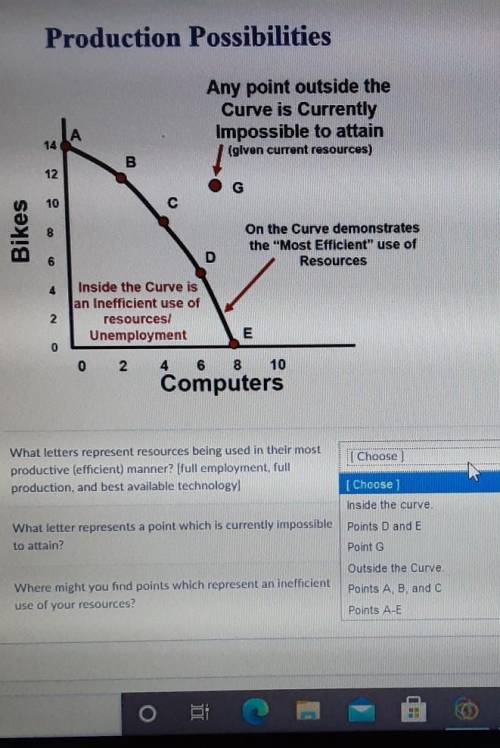

The answer options for each question is in the picture

...

Answers: 1

Another question on Business

Business, 21.06.2019 22:50

Tara incorporates her sole proprietorship, transferring it to newly formed black corporation. the assets transferred have an adjusted basis of $240,000 and a fair market value of $300,000. also transferred was $10,000 in liabilities, $1,000 of which was personal and the balance of $9,000 being business related. in return for these transfers, tara receives all of the stock in black corporation. a. black corporation has a basis of $241,000 in the property. b. black corporation has a basis of $240,000 in the property. c. tara’s basis in the black corporation stock is $241,000. d. tara’s basis in the black corporation stock is $249,000. e. none of the above.

Answers: 1

Business, 22.06.2019 07:00

Amarket that consists of all possible consumers regardless of their specific needs or wants is a

Answers: 1

Business, 22.06.2019 09:40

The relationship requirement for qualifying relative requires the potential qualifying relative to have a family relationship with the taxpayer. t or fwhich of the following is not a from agi deduction? a.standard deductionb.itemized deductionc.personal exemptiond.none of these. all of these are from agi deductions

Answers: 3

You know the right answer?

Questions

Mathematics, 16.10.2020 17:01

English, 16.10.2020 17:01

English, 16.10.2020 17:01

English, 16.10.2020 17:01

English, 16.10.2020 17:01

Biology, 16.10.2020 17:01

Mathematics, 16.10.2020 17:01

Mathematics, 16.10.2020 17:01

Social Studies, 16.10.2020 17:01

Mathematics, 16.10.2020 17:01