Business, 22.02.2021 20:00 austinshamblin8456

A u. s navy recruiting center knows from past experience that the height of its recruits traditionally been distributed with mean 69 inches. The recruiting center wants to test the claim that the average height of this year's recruits is greater than 69 inches. To do so recruiting personnel to take a random sample of 64 recruits from this year and recorded their heights.

a. identify the null and alternate hypothesis.

b. Do the recruiters find support form the given claim at the 5% significance level.

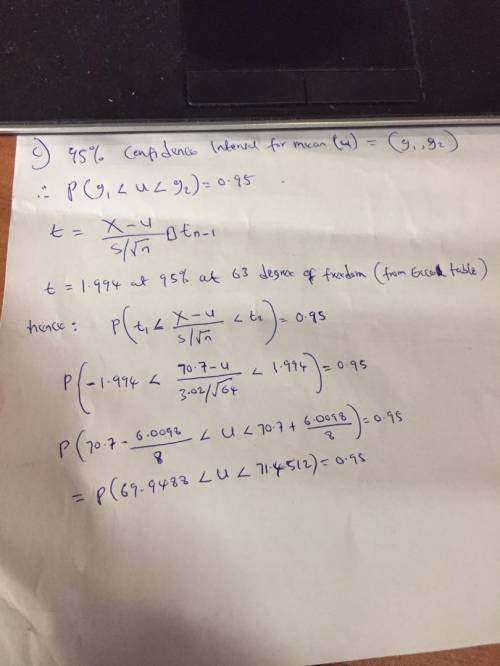

c. Use sample date to calculate a 95% confidence interval for the average height .conclude?

Recruit Height

1 74.5

2 74.0

3 74.6

4 69.8

5 76.0

6 72.3

7 66.0

8 70.6

9 71.9

10 71.4

11 70.6

12 73.9

13 69.3

14 75.3

15 71.5

16 65.5

17 60.5

18 71.9

19 70.7

20 70.6

21 73.4

22 72.1

23 69.3

24 74.7

25 68.5

26 70.5

27 70.0

28 69.9

29 71.7

30 73.0

31 68.8

32 75.0

33 67.5

34 71.3

35 69.5

36 65.3

37 74.8

38 70.5

39 71.5

40 67.6

41 69.1

42 72.1

43 72.8

44 68.3

45 71.8

46 67.1

47 72.3

48 70.7

49 70.4

50 69.1

51 70.8

52 71.6

53 73.6

54 64.8

55 68.5

56 68.5

57 74.3

58 66.5

59 74.8

60 74.1

61 71.6

62 66.3

63 67.1

64 71.7

Answers: 3

Another question on Business

Business, 22.06.2019 12:50

Jallouk corporation has two different bonds currently outstanding. bond m has a face value of $50,000 and matures in 20 years. the bond makes no payments for the first six years, then pays $2,100 every six months over the subsequent eight years, and finally pays $2,400 every six months over the last six years. bond n also has a face value of $50,000 and a maturity of 20 years; it makes no coupon payments over the life of the bond. the required return on both these bonds is 10 percent compounded semiannually. what is the current price of bond m and bond n?

Answers: 3

Business, 22.06.2019 15:00

Magic realm, inc., has developed a new fantasy board game. the company sold 15,000 games last year at a selling price of $20 per game. fixed expenses associated with the game total $182,000 per year, and variable expenses are $6 per game. production of the game is entrusted to a printing contractor. variable expenses consist mostly of payments to this contractor.required: 1-a. prepare a contribution format income statement for the game last year.1-b. compute the degree of operating leverage.2. management is confident that the company can sell 58,880 games next year (an increase of 12,880 games, or 28%, over last year). given this assumption: a. what is the expected percentage increase in net operating income for next year? b. what is the expected amount of net operating income for next year? (do not prepare an income statement; use the degree of operating leverage to compute your answer.)

Answers: 2

Business, 22.06.2019 20:30

Blue computers, a major pc manufacturer in the united states, currently has plants in kentucky and pennsylvania. the kentucky plant has a capacity of 1 million units a year and the pennsylvania plant has a capacity of 1.5 million units a year. the firm divides the united states into five markets: northeast, southeast, midwest, south, and west. each pc sells for $1,000. the firm anticipates a 50 perc~nt growth in demand (in each region) this year (after which demand will stabilize) and wants to build a plant with a capacity of 1.5 million units per year to accommodate the growth. potential sites being considered are in north carolina and california. currently the firm pays federal, state, and local taxes on the income from each plant. federal taxes are 20 percent of income, and all state and local taxes are 7 percent of income in each state. north carolina has offered to reduce taxes for the next 10 years from 7 percent to 2 percent. blue computers would like to take the tax break into consideration when planning its network. consider income over the next 10 years in your analysis. assume that all costs remain unchanged over the 10 years. use a discount factor of 0.1 for your analysis. annual fixed costs, production and shipping costs per unit, and current regional demand (before the 50 percent growth) are shown in table 5-13. (a) if blue computers sets an objective of minimizing total fixed and variable costs, where should they build the new plant? how should the network be structured? (b) if blue computers sets an objective of maximizing after-tax profits, where should they build the new plant? how should the network be structured? variable production and shipping cost ($/unit) annual fixed cost northeast southeast midwest south west (million$) kentucky 185 180 175 175 200 150 pennsylvania 170 190 180 200 220 200 n. carolina 180 180 185 185 215 150 california 220 220 195 195 175 150 demand ('000 units/month) 700 400 400 300 600

Answers: 3

Business, 23.06.2019 02:00

Acompany sells garden hoses and uses the perpetual inventory system to account for its merchandise. the beginning balance of the inventory and its transactions during september were as follows:

Answers: 2

You know the right answer?

A u. s navy recruiting center knows from past experience that the height of its recruits traditional...

Questions

Mathematics, 30.11.2019 01:31

Biology, 30.11.2019 02:31

History, 30.11.2019 02:31

Biology, 30.11.2019 02:31

Social Studies, 30.11.2019 02:31

History, 30.11.2019 02:31

Health, 30.11.2019 02:31

History, 30.11.2019 02:31

=

=  = 4.503

= 4.503