Answers: 2

Another question on Business

Business, 21.06.2019 17:00

The typical consumer's food basket in the base year 2015 is as follows: 30 chickens at $4 each 10 hams at $5 each 10 steaks at $8 each a chicken feed shortage causes the price of chickens to rise to $5.00 each in the year 2016. hams rise to $7.00 each, and the price of steaks is unchanged. a. calculate the change in the "cost-of-eating" index between 2015 and 2016. year cost of the basket 2015 $ 2016 $ instructions: enter your responses rounded to one decimal place. the official cost-of-eating index has by %. b. suppose that consumers are completely indifferent between two chickens and one ham. for this example, how large is the substitution bias in the official "cost-of-eating" index? the in the cost-of-eating index is %. the of inflation in the cost of eating reflects substitution bias.

Answers: 3

Business, 22.06.2019 03:10

Complete the sentences. upper a decrease in current income taxes the supply of loanable funds today because it a. decreases; increases disposable income, which decreases saving b. has no effect on; doesn't change expected future disposable income c. decreases; decreases expected future disposable income d. increases; increases disposable income, which encourages greater saving upper a decrease in expected future income a. increases the supply of loanable funds today because households with smaller expected future income will save more today b. has no effect on the supply of loanable funds c. decreases the supply of loanable funds because it decreases wealth d. decreases the supply of loanable funds today because households with smaller expected future income will save less today

Answers: 3

Business, 22.06.2019 08:00

Shrieves casting company is considering adding a new line to its product mix, and the capital budgeting analysis is being conducted by sidney johnson, a recently graduated mba. the production line would be set up in unused space in the main plant. the machinery’s invoice price would be approximately $200,000, another $10,000 in shipping charges would be required, and it would cost an additional $30,000 to install the equipment. the machinery has an economic life of 4 years, and shrieves has obtained a special tax ruling that places the equipment in the macrs 3-year class. the machinery is expected to have a salvage value of $25,000 after 4 years of use. the new line would generate incremental sales of 1,250 units per year for 4 years at an incremental cost of $100 per unit in the first year, excluding depreciation. each unit can be sold for $200 in the first year. the sales price and cost are both expected to increase by 3% per year due to inflation. further, to handle the new line, the firm’s net working capital would have to increase by an amount equal to 12% of sales revenues. the firm’s tax rate is 40%, and its overall weighted average cost of capital, which is the risk-adjusted cost of capital for an average project (r), is 10%. define “incremental cash flow.” (1) should you subtract interest expense or dividends when calculating project cash flow?

Answers: 1

Business, 22.06.2019 08:40

Mcdonald's fast-food restaurants have a well-designed training program for all new employees. each new employee is supposed to learn how to perform standardized tasks required to maintain mcdonald's service quality. due to labor shortages in some areas, new employees begin work as soon as they are hired and do not receive any off-the-job training. this nonconformity to standards creates

Answers: 2

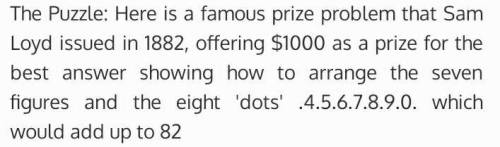

You know the right answer?

Qtr5g66677

Math problem

...

Math problem

...

Questions

Social Studies, 05.01.2021 19:10

Mathematics, 05.01.2021 19:10

Biology, 05.01.2021 19:10

Mathematics, 05.01.2021 19:10

History, 05.01.2021 19:10

Mathematics, 05.01.2021 19:10

Chemistry, 05.01.2021 19:10

Mathematics, 05.01.2021 19:10