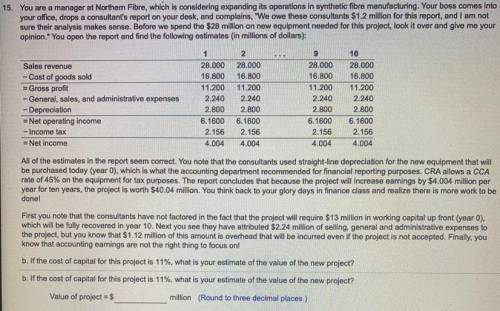

15. You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a

consultant's report on your desk, and complains, "We owe these consultants $1.2 million for this report, and I am not sure their analysis makes sense. Before

we spend the $28 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates

(in Millions of dollars):

1

2

9

10

Sales revenue

28.000 28.000

28.000 28.000

- Cost of goods sold

16.800 16.800

16.800 16.800

= Gross profit

11.200 11.200

11.200 11.200

- General, sales, and administrative expenses 2.240 2.240

2.240 2.240

- Depreciation

2.800 2.800

2.800 2.800

= Net operating income

6.1600 6.1600

6.1600 6.1600

- Income tax

2.156 2.156

2.156 2.156

= Net income

4.004 4.004

4.004 4.004

All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new equipment that will be purchased today

(year o), which is what the accounting department recommended for financial reporting purposes. CRA allows a CCA rate of 45% on the equipment for tax

purposes. The report concludes that because the project will increase earnings by $4.004 million per year for ten years, the project is worth $40.04 million. You

think back to your glory days in finance class and realize there is more work to be done!

First you note that the consultants have not factored in the fact that the project will require S13 million in working capital up front (year o), which will be fully

recovered in year 10. Next you see they have attributed $2.24 million of selling, general and administrative expenses to the project, but you know that $1.12

million of this amount is overhead that will be incurred even if the project is not accepted. Finally, you know that accounting earnings are not the right thing to

focus on!

b. If the cost of capital for this project is 11%, what is your estimate of the value of the new project?

b. If the cost of capital for this project is 11%, what is your estimate of the value of the new project?

Value of project = 5

million (Round to three decimal places.)

Answers: 2

Another question on Business

Business, 22.06.2019 11:40

In each of the following, what happens to the unemployment rate? does the unemployment rate give an accurate impression of what’s happening in the labor market? a.esther lost her job and begins looking for a new one.b.sam, a steelworker who has been out of work since his mill closed last year, becomes discouraged and gives up looking for work.c.dan, the sole earner in his family of 5, just lost his $90,000 job as a research scientist. immediately, he takes a part-time job at starbucks until he can find another job in his field.

Answers: 2

Business, 22.06.2019 16:30

Penelope summers received certain income benefits in 2018. she received $1,400 of state unemployment insurance benefits, $2,000 from a federal unemployment trust fund and $3,700 workers’ compensation received for an occupational injury. what amount of the compensation must penelope include in her income

Answers: 1

Business, 22.06.2019 17:30

Emery pharmaceutical uses an unstable chemical compound that must be kept in an environment where both temperature and humidity can be controlled. emery uses 825 pounds per month of the chemical, estimates the holding cost to be 50% of the purchase price (because of spoilage), and estimates order costs to be $48 per order. the cost schedules of two suppliers are as follows: vendor 1 vendor 2 quantity price/lb quantity price/lb 1-499 $17 1-399 $17.10 500-999 $16.75 400-799 $16.85 1000+ $16.50 800-1199 $16.60 1200+ $16.25 (a) what is the economic order quantity for each supplier? (b) what quantity should be ordered and which supplier should be used? (c) the total cost for the most economic order sire is $

Answers: 2

Business, 22.06.2019 19:00

Which of the following would cause a shift to the right of the supply curve for gasoline? i. a large increase in the price of public transportation. ii. a large decrease in the price of automobiles. iii. a large reduction in the costs of producing gasoline

Answers: 1

You know the right answer?

15. You are a manager at Northern Fibre, which is considering expanding its operations in synthetic...

Questions

English, 04.03.2021 21:00

Physics, 04.03.2021 21:00

Geography, 04.03.2021 21:00

Mathematics, 04.03.2021 21:00

Mathematics, 04.03.2021 21:00

Chemistry, 04.03.2021 21:00

Mathematics, 04.03.2021 21:00

English, 04.03.2021 21:00

Mathematics, 04.03.2021 21:00

Mathematics, 04.03.2021 21:00