Business, 18.02.2021 20:50 acavalieri72

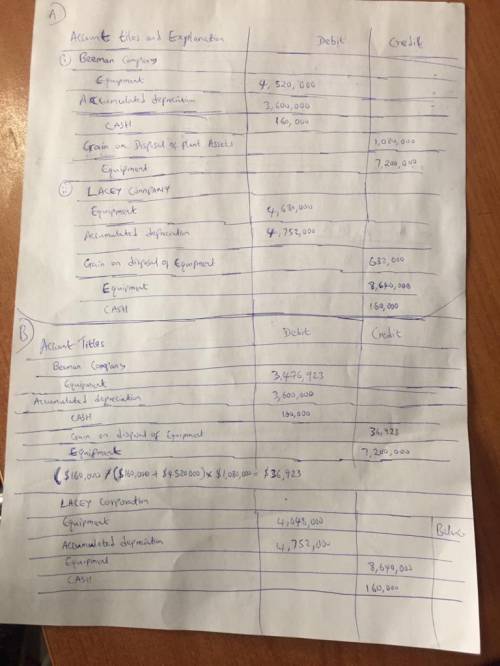

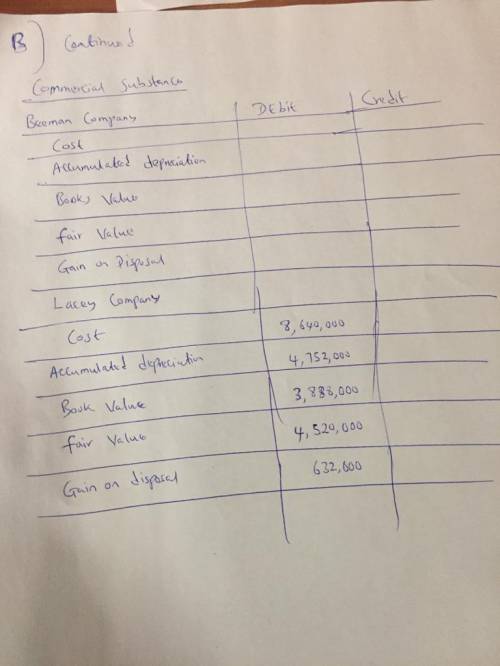

Beeman Company exchanged machinery with an appraised value of $4,680,000, a recorded cost of $7,200,000 and accumulated depreciation of $3,600,000 with Lacey Corporation for machinery Lacey owns. The machinery has an appraised value of $4,520,000, a recorded cost of $8,640,000, and accumulated depreciation of $4,752,000. Lacey also gave Beeman $160,000 in the exchange. Assume depreciation has already been updated. Instructions(a) Prepare the entries on both companies' books assuming that the exchange lacked commercial substance. (Round all computations to the nearest dollar.) (b) Prepare the entries on both companies ; books assuming that the exchange had commercial substance. (Round all computations to the nearest dollar.)

Answers: 3

Another question on Business

Business, 22.06.2019 16:30

Bernard made a gift of $500,000 to his brother in 2014. due to bernard’s prior taxable gifts he paid $200,000 of gift tax. when bernard died in 2019, the applicable gift tax credit had increased. at bernard’s death, what amount related to the $500,000 gift to his brother is included in his gross estate?

Answers: 3

Business, 22.06.2019 19:40

The martinez legal firm (mlf) recently acquired a smaller competitor, miller and associates, which specializes in issues not previously covered by mlf, such as land use and intellectual property cases. given the increase in the firm's size and complexity, it is likely that its internal transaction costs willa. decrease. b. increase. c. become external transaction costs. d. be eliminated.

Answers: 3

Business, 23.06.2019 10:00

Francesca opened a checking account at first bank one month ago. during the month she wrote 25 checks. first bank will charge her $.25 per check. this fee per check is called a a. service charge b. monthly charge c. transfer charge d. debit charge

Answers: 2

You know the right answer?

Beeman Company exchanged machinery with an appraised value of $4,680,000, a recorded cost of $7,200,...

Questions

Chemistry, 28.01.2021 20:20

Mathematics, 28.01.2021 20:20

Mathematics, 28.01.2021 20:20

Mathematics, 28.01.2021 20:20

Law, 28.01.2021 20:20

English, 28.01.2021 20:20

Mathematics, 28.01.2021 20:20