Old Nest Company of Guandong, China, is a family-owned enterprise that makes birdcages for the South China market. The company sells its birdcages through an extensive network of street vendors who receive commissions on their sales.

The company uses a job-order costing system in which overhead is applied to jobs on the basis of direct labor cost. Its predetermined overhead rate is based on a cost formula that estimated $330,000 of manufacturing overhead for an estimated activity level of $200,000 direct labor dollars. At the beginning of the year, the inventory balances were as follows:

Raw materials $ 25,000

Work in process $ 10,000

Finished goods $ 40,000

During the year, the following transactions were completed:

Raw materials purchased on account, $275,000.

Raw materials used in production, $280,000 (materials costing $220,000 were charged directly to jobs; the remaining materials were indirect).

Costs for employee services were incurred as follows:

Direct labor $ 180,000

Indirect labor $ 72,000

Sales commissions $ 63,000

Administrative salaries $ 90,000

Rent for the year was $18,000 ($13,000 of this amount related to factory operations, and the remainder related to selling and administrative activities).

Utility costs incurred in the factory, $57,000.

Advertising costs incurred, $140,000.

Depreciation recorded on equipment, $100,000. ($88,000 of this amount related to equipment used in factory operations; the remaining $12,000 related to equipment used in selling and administrative activities.)

Manufacturing overhead cost was applied to jobs, $ ? .

Goods that had cost $675,000 to manufacture according to their job cost sheets were completed.

Sales for the year (all paid in cash) totaled $1,250,000. The total cost to manufacture these goods according to their job cost sheets was $700,000.

Required:

1. Prepare journal entries to record the transactions for the year.

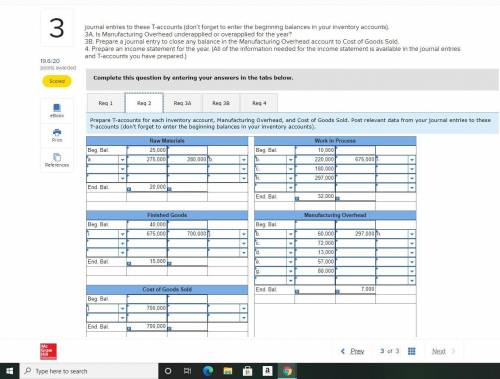

2. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journal entries to these T-accounts (don’t forget to enter the beginning balances in your inventory accounts).

3A. Is Manufacturing Overhead underapplied or overapplied for the year?

3B. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold.

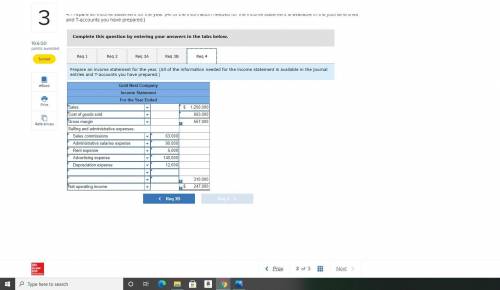

4. Prepare an income statement for the year. (All of the information needed for the income statement is available in the journal entries and T-accounts you have prepared.)

Answers: 2

Another question on Business

Business, 22.06.2019 17:20

“strategy, plans, and budgets are unrelated to one another.” do you agree? explain. explain how the manager’s choice of the type of responsibility center (cost, revenue, profit, or investment) affects the behavior of other employees.

Answers: 3

Business, 22.06.2019 19:00

The east asiatic company (eac), a danish company with subsidiaries throughout asia, has been funding its bangkok subsidiary primarily with u.s. dollar debt because of the cost and availability of dollar capital as opposed to thai baht-denominated (b) debt. the treasurer of eac-thailand is considering a 1-year bank loan for $247,000.the current spot rate is b32.03 /$, and the dollar-based interest is 6.78% for the 1-year period. 1-year loans are 12.04% in baht.a. assuming expected inflation rates of 4.3 % and 1.24% in thailand and the united states, respectively, for the coming year, according to purchase power parity, what would the effective cost of funds be in thai baht terms? b. if eac's foreign exchange advisers believe strongly that the thai government wants to push the value of the baht down against the dollar by5% over the coming year (to promote its export competitiveness in dollar markets), what might the effective cost of funds end up being in baht terms? c. if eac could borrow thai baht at 13% per annum, would this be cheaper than either part (a) or part (b) above?

Answers: 2

Business, 22.06.2019 22:30

Schuepfer inc. bases its selling and administrative expense budget on budgeted unit sales. the sales budget shows 1,800 units are planned to be sold in march. the variable selling and administrative expense is $4.30 per unit. the budgeted fixed selling and administrative expense is $35,620 per month, which includes depreciation of $2,700 per month. the remainder of the fixed selling and administrative expense represents current cash flows. the cash disbursements for selling and administrative expenses on the march selling and administrative expense budget should be:

Answers: 1

Business, 23.06.2019 00:00

Both a demand curve and a demand schedule show how a. prices affect consumer demand. b. consumer demand affects income. c. prices affect complementary goods. d. consumer demand affects substitute goods.

Answers: 2

You know the right answer?

Old Nest Company of Guandong, China, is a family-owned enterprise that makes birdcages for the South...

Questions

Mathematics, 24.03.2021 21:40

Biology, 24.03.2021 21:40

History, 24.03.2021 21:40

History, 24.03.2021 21:40

History, 24.03.2021 21:40

Biology, 24.03.2021 21:40

Computers and Technology, 24.03.2021 21:40

Mathematics, 24.03.2021 21:40

Mathematics, 24.03.2021 21:40