Business, 12.02.2021 09:40 oliwia0765

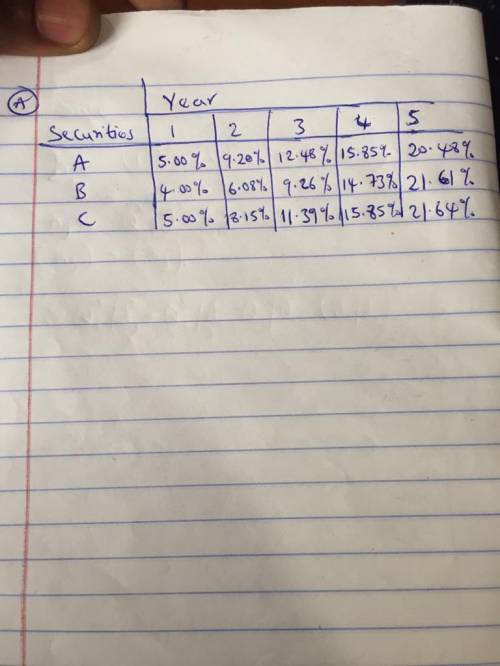

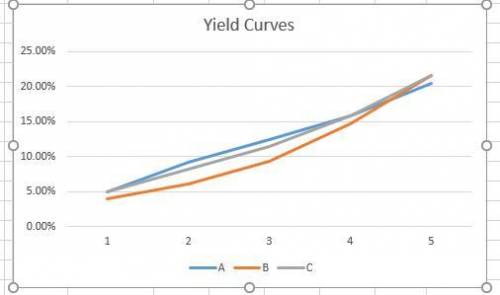

There are 3 term securities available with the following series of 1-year interest rates:Security A:5%, 4%, 3%, 3%, 4%Security B:4%, 2%, 3%, 5%, 6%Security C:5%, 3%, 3%, 4%, 5%Assume the expectations theory (without uncertainty) of the term structure is correct:(a)Calculate the term structure interest rates for maturities of 1 to 5 years, for all 3 securities.(b)Draw the yield curves for the 3 term securities of length 1 to 5 years.(c)Which security, if you must choose 1, will you buy if you plan to have it mature in 3 years

Answers: 2

Another question on Business

Business, 22.06.2019 15:20

Capital financial corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. the current prime rate is 16.50 percent, and capital charges 3.50 percent over prime to charming as its annual loan rate. a. determine the maximum loan for which charming paper company could qualify.

Answers: 1

Business, 22.06.2019 16:50

Arestaurant that creates a new type of sandwich is using (blank) as a method of competition.

Answers: 1

Business, 22.06.2019 21:40

Western electric has 32,000 shares of common stock outstanding at a price per share of $79 and a rate of return of 13.00 percent. the firm has 7,300 shares of 7.80 percent preferred stock outstanding at a price of $95.00 per share. the preferred stock has a par value of $100. the outstanding debt has a total face value of $404,000 and currently sells for 111 percent of face. the yield to maturity on the debt is 8.08 percent. what is the firm's weighted average cost of capital if the tax rate is 39 percent?

Answers: 2

Business, 22.06.2019 21:40

Penny poodle wanted to know which dog obedience training program was more effective: puppy pride, the approach she has been using for any years, or doggie do-right, a new approach. penny convinced 50 human companions of untrained dogs to participate in her study. the dogs and their humans were randomly assigned to complete the puppy pride or doggie do-right course. at the end of the training programs, all of the dogs were scored on their level of obedience on a standardized dog obedience checklist (scores could range from 10 to 100). the design of this study is:

Answers: 2

You know the right answer?

There are 3 term securities available with the following series of 1-year interest rates:Security A:...

Questions

Mathematics, 23.04.2020 18:02

Social Studies, 23.04.2020 18:02

Mathematics, 23.04.2020 18:02

Mathematics, 23.04.2020 18:02

History, 23.04.2020 18:02

Mathematics, 23.04.2020 18:02

History, 23.04.2020 18:02

Mathematics, 23.04.2020 18:02

Mathematics, 23.04.2020 18:02

Social Studies, 23.04.2020 18:02