Business, 11.02.2021 18:20 rsetser6989

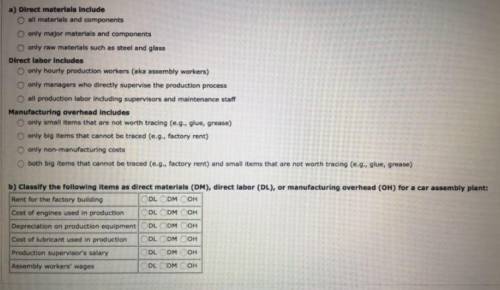

Question 3: Cost terminology in manufacturing firms a) Direct materials include all materials and components only raw materials such as steel and glass only major materials and components Correct: Your answer is correct. Direct labor includes all production labor including supervisors and maintenance staff only managers who directly supervise the production process only hourly production workers (aka assembly workers) Correct: Your answer is correct. Manufacturing overhead includes only big items that cannot be traced (e. g., factory rent) only non-manufacturing costs only small items that are not worth tracing (e. g., glue, grease) both big items that cannot be traced (e. g., factory rent) and small items that are not worth tracing (e. g., glue, grease) Correct: Your answer is correct. b) Classify the following items as direct materials (DM), direct labor (DL), or manufacturing overhead (OH) for a car assembly plant: Rent for the factory building DL DM OH Correct: Your answer is correct. Cost of engines used in production DL DM OH Correct: Your answer is correct. Depreciation on production equipment DL DM OH Correct: Your answer is correct. Cost of lubricant used in production DL DM OH Correct: Your answer is correct. Production supervisor's salary DL DM OH Correct: Your answer is correct. Assembly workers' wages DL DM OH Correct: Your answer is correct.

Answers: 1

Another question on Business

Business, 21.06.2019 20:20

After all revenue and expense accounts have been closed at the end of the fiscal year, income summary has a debit of $2,450,000 and a credit of $3,000,000. at the same date, retained earnings has a credit balance of $8,222,600, and dividends has a balance of $125,000. required: a. journalize the entries required to complete the closing of the accounts on december 31. refer to the chart of accounts for exact wording of account titles. b. determine the amount of retained earnings at the end of the period.

Answers: 1

Business, 21.06.2019 23:00

Each of the four independent situations below describes a sales-type lease in which annual lease payments of $12,500 are payable at the beginning of each year. each is a finance lease for the lessee. (fv of $1, pv of $1, fva of $1, pva of $1, fvad of $1 and pvad of $1) (use appropriate factor(s) from the tables provided.) situation 1 2 3 4 lease term (years) 3 3 3 3 asset’s useful life (years) 3 4 4 6 lessor’s implicit rate (known by lessee) 14 % 14 % 14 % 14 % residual value: guaranteed by lessee 0 $ 5,000 $ 2,500 0 unguaranteed 0 0 $ 2,500 $ 5,000 purchase option: after (years) none 2 3 3 exercise price n/a $ 7,500 $ 1,500 $ 3,500 reasonably certain? n/a no no yes

Answers: 1

Business, 22.06.2019 01:30

Ben collins plans to buy a house for $166,000. if the real estate in his area is expected to increase in value by 2 percent each year, what will its approximate value be five years from now?

Answers: 1

Business, 22.06.2019 03:10

Transactions that affect earnings do not necessarily affect cash. identify the effect, if any, that each of the following transactions would have upon cash and net income. the first transaction has been completed as an example. (if an amount reduces the account balance then enter with negative sign preceding the number e.g. -15,000 or parentheses e.g. (15, cash net income (a) purchased $120 of supplies for cash. –$120 $0 (b) recorded an adjustment to record use of $35 of the above supplies. (c) made sales of $1,370, all on account. (d) received $700 from customers in payment of their accounts. (e) purchased equipment for cash, $2,450. (f) recorded depreciation of building for period used, $740. click if you would like to show work for this question: open show work

Answers: 3

You know the right answer?

Question 3: Cost terminology in manufacturing firms a) Direct materials include all materials and co...

Questions

Health, 01.10.2019 05:00

Spanish, 01.10.2019 05:00

English, 01.10.2019 05:00

History, 01.10.2019 05:00

Chemistry, 01.10.2019 05:00

Mathematics, 01.10.2019 05:00

Mathematics, 01.10.2019 05:00

Mathematics, 01.10.2019 05:00

Physics, 01.10.2019 05:00

Mathematics, 01.10.2019 05:00