Guthrie Generators manufactures a solenoid that it uses in several of its products. Management is considering whether to continue manufacturing the solenoids or to buy them from an outside source. The following information is available.

The company needs 18,000 solenoids per year. The solenoids can be purchased from an outside supplier at a cost of $14 per unit.

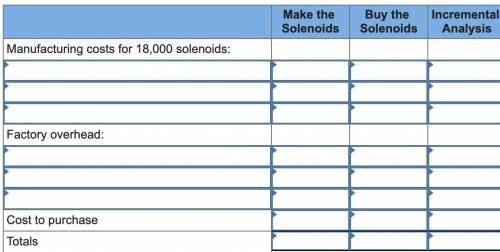

The unit cost of manufacturing the solenoids is $20, computed as follows.

Direct materials $ 162,000

Direct labor 36,000

Factory overhead:

Variable 72,000

Fixed 90,000

Total manufacturing costs $ 360,000

Cost per unit ($360,000 ÷ 18,000 units) $ 20

If the company decides not to manufacture the solenoids, it will eliminate all of the raw materials and direct labor costs, but will eliminate only 60 percent of the variable factory overhead costs.

If the solenoids are purchased from the outside source, machinery used in the production of solenoids will be sold at its book value. Accordingly, no gain or loss will be recognized. The sale of this machinery would also eliminate $4,000 in fixed costs associated with depreciation and taxes. No other reductions in fixed factory overhead will result from discontinuing the production of the solenoids.

Required:

a-1. Prepare a schedule to determine the incremental cost or benefit of buying the solenoids from the outside supplier.

a-2. Would you recommend that the company manufacture the solenoids or buy them from the outside source?

b-1. Assume that if the solenoids are purchased from the outside source, the manufacturing space previously used to produce them can be used to manufacture an additional 5,000 electric wire harnesses used in the installation of home generators. The wire harnesses have an estimated contribution margin of $3 per unit. Manufacturing additional wire harnesses would have no effect on fixed factory overhead. Compute incremental cost or benefit of buying the solenoids from the outside source and using the factory space to produce additional wire harnesses.

b-2. Would this new assumption change your recommendation as to whether to make or buy the solenoids?

Answers: 3

Another question on Business

Business, 22.06.2019 06:30

"in my opinion, we ought to stop making our own drums and accept that outside supplier's offer," said wim niewindt, managing director of antilles refining, n.v., of aruba. "at a price of $21 per drum, we would be paying $4.70 less than it costs us to manufacture the drums in our own plant. since we use 70,000 drums a year, that would be an annual cost savings of $329,000." antilles refining's current cost to manufacture one drum is given below (based on 70,000 drums per year):

Answers: 1

Business, 22.06.2019 11:40

If kroger had whole foods’ number of days’ sales in inventory, how much additional cash flow would have been generated from the smaller inventory relative to its actual average inventory position? round interim calculations to one decimal place and your final answer to the nearest million.

Answers: 2

Business, 22.06.2019 16:00

Arnold rossiter is a 40-year-old employee of the barrington company who will retire at age 60 and expects to live to age 75. the firm has promised a retirement income of $20,000 at the end of each year following retirement until death. the firm's pension fund is expected to earn 7 percent annually on its assets and the firm uses 7% to discount pension benefits. what is barrington's annual pension contribution to the nearest dollar for mr. rossiter? (assume certainty and end-of-year cash flows.)

Answers: 2

Business, 22.06.2019 20:10

Quick computing currently sells 12 million computer chips each year at a price of $19 per chip. it is about to introduce a new chip, and it forecasts annual sales of 22 million of these improved chips at a price of $24 each. however, demand for the old chip will decrease, and sales of the old chip are expected to fall to 6 million per year. the old chips cost $10 each to manufacture, and the new ones will cost $14 each. what is the proper cash flow to use to evaluate the present value of the introduction of the new chip? (enter your answer in millions.)

Answers: 1

You know the right answer?

Guthrie Generators manufactures a solenoid that it uses in several of its products. Management is co...

Questions

English, 31.03.2021 19:40

English, 31.03.2021 19:40

Biology, 31.03.2021 19:40

Mathematics, 31.03.2021 19:40

Computers and Technology, 31.03.2021 19:40

History, 31.03.2021 19:40

Social Studies, 31.03.2021 19:40

English, 31.03.2021 19:40

Spanish, 31.03.2021 19:40

Social Studies, 31.03.2021 19:40

Physics, 31.03.2021 19:40

Business, 31.03.2021 19:40