Answers: 3

Another question on Business

Business, 22.06.2019 04:00

Don’t give me to many notifications because it will cause you to lose alot of points

Answers: 1

Business, 22.06.2019 06:00

Suppose that a monopolistically competitive restaurant is currently serving 260 meals per day (the output where mr

Answers: 2

Business, 22.06.2019 14:30

What’s the present value of a perpetuity that pays $250 per year if the appropriate interest rate is 5%? $4,750 $5,000 $5,250 $5,513 $5,788what is the present value of the following cash flow stream at a rate of 8.0%, rounded to the nearest dollar? cash flows: today (t = 0) it is $750, after one year (t = 1) it is $2,450, at t = 2 it is $3,175, and at t=3 it is $4,400. draw a time line. $7,917 $8,333 $8,772 $9,233 $9,695

Answers: 2

Business, 22.06.2019 20:00

Question 6 of 102 pointswhich situation shows a constant rate of change? oa. the number of tickets sold compared with the number of minutesbefore a football gameob. the height of a bird over timeoc. the cost of a bunch of grapes compared with its weightod. the outside temperature compared with the time of day

Answers: 1

You know the right answer?

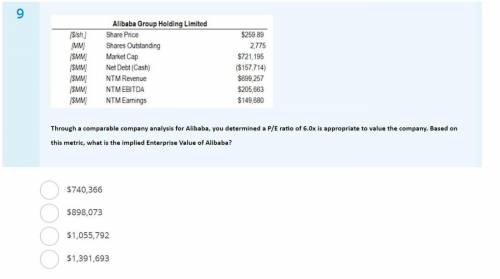

Through a comparable company analysis for Alibaba, you determined a P/E ratio of 6.0x is appropriate...

Questions

English, 03.05.2021 23:30

Arts, 03.05.2021 23:30

Mathematics, 03.05.2021 23:30

Mathematics, 03.05.2021 23:30

Mathematics, 03.05.2021 23:30

English, 03.05.2021 23:30

Mathematics, 03.05.2021 23:30

SAT, 03.05.2021 23:30

Mathematics, 03.05.2021 23:30

English, 03.05.2021 23:30