Business, 05.02.2021 23:30 landofliam30

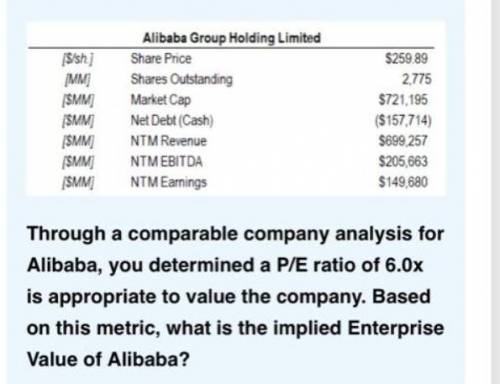

Through a comparable company analysis for Alibaba, you determined a P/E ratio of 6.0x is appropriate to value the company. Based on this metric, what is the implied Enterprise Value of Alibaba? Review Later $740,366 $1,391,693 $1,055,792 $898,073

Answers: 3

Another question on Business

Business, 22.06.2019 11:30

4. chef a says that broth should be brought to a boil. chef b says that broth should be kept at an even, gentle simmer. which chef is correct? a. neither chef is correct. b. chef a is correct. c. both chefs are correct. d. chef b is correct. student c incorrect which is right answer

Answers: 2

Business, 22.06.2019 19:00

Consider the following information on stocks a, b, c and their returns (in decimals) in each state: state prob. of state a b c boom 20% 0.27 0.22 0.16 good 45% 0.16 0.09 0.07 poor 25% 0.03 0 0.03 bust 10% -0.08 -0.04 -0.02 if your portfolio is invested 25% in a, 40% in b, and 35% in c, what is the standard deviation of the portfolio in percent? answer to two decimals, carry intermediate calcs. to at least four decimals.

Answers: 2

Business, 22.06.2019 20:00

Lillypad toys is a manufacturer of educational toys for children. six months ago, the company's research and development division came up with an idea for a unique touchscreen device that can be used to introduce children to a number of foreign languages. three months ago, the company produced a working prototype, and last month the company successfully launched its new device on the commercial market. what should lillypad's managers prepare for next? a. increased competition from imitators b. a prolonged period of uncontested success c. a sharp decline in demand for the product d. a difficult struggle to move from invention to innovation

Answers: 2

Business, 22.06.2019 23:10

The direct labor budget of yuvwell corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor-hours: 1st quarter 2nd quarter 3rd quarter 4th quarterbudgeted direct labor-hours 11,200 9,800 10,100 10,900the company uses direct labor-hours as its overhead allocation base. the variable portion of its predetermined manufacturing overhead rate is $6.00 per direct labor-hour and its total fixed manufacturing overhead is $80,000 per quarter. the only noncash item included in fixed manufacturing overhead is depreciation, which is $20,000 per quarter.required: 1. prepare the company’s manufacturing overhead budget for the upcoming fiscal year.2. compute the company’s predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year.

Answers: 3

You know the right answer?

Through a comparable company analysis for Alibaba, you determined a P/E ratio of 6.0x is appropriate...

Questions