Business, 02.02.2021 02:00 damondgriswold12

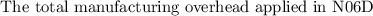

Look Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, N06D and M09K, about which it has provided the following data: N06D M09K Direct materials per unit $ 33.40 $ 61.20 Direct labor per unit $ 6.00 $ 28.00 Direct labor-hours per unit 0.20 1.00 Annual production (units) 48,200 15,000 The company's estimated total manufacturing overhead for the year is $1,754,571 and the company's estimated total direct labor-hours for the year is 24,640. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below: Activities and Activity Measures Estimated Overhead Cost Supporting direct labor (DLHs) $ 862,400 Setting up machines (setups) 476,307 Parts administration (part types) 415,864 Total $ 1,754,571 Expected Activity N06D M09K Total DLHs 9640 15,000 24,640 Setups 1670 1021 2691 Part types 641 267 908 The manufacturing overhead that would be applied to a unit of product N06D under the company's traditional costing system is closest to: (Round your intermediate calculations to 2 decimal places.) Group of answer choices

Answers: 3

Another question on Business

Business, 22.06.2019 00:00

Chance company had two operating divisions, one manufacturing farm equipment and the other office supplies. both divisions are considered separate components as defined by generally accepted accounting principles. the farm equipment component had been unprofitable, and on september 1, 2018, the company adopted a plan to sell the assets of the division. the actual sale was completed on december 15, 2018, at a price of $600,000. the book value of the division’s assets was $1,000,000, resulting in a before-tax loss of $400,000 on the sale. the division incurred a before-tax operating loss from operations of $130,000 from the beginning of the year through december 15. the income tax rate is 40%. chance’s after-tax income from its continuing operations is $350,000. required: prepare an income statement for 2018 beginning with income from continuing operations. include appropriate eps disclosures assuming that 100,000 shares of common stock were outstanding throughout the year. (amounts to be deducted should be indicated with a minus sign. round eps answers to 2 decimal places.)

Answers: 2

Business, 22.06.2019 10:00

How has internet access changed and affected globalization from 2003 to 2013? a ten percent increase in internet access has had little effect on globalization. a twenty percent decrease in internet access has had little effect on globalization. a thirty percent increase in internet access has sped up globalization. a fifty percent decrease in internet access has slowed down globalization.

Answers: 1

Business, 22.06.2019 14:20

Frugala is when sylvestor puts $2,000 into 10-year state bonds and $3,000 into 5-year aaa-rated bonds in steady hand hardware, inc. he buys the four state bonds at a 5 percent interest rate and the three steady hand bonds at a 6.5 percent rate. sylvestor also buys $1,500 worth of blue chip stocks, and $800 worth of stock in a promising new sportswear company that reinvests its earnings in new growth. 1. (a) what is the maturity for each of the bond groups sylvestor buys? (b) the coupon rate? (c) the par value?

Answers: 3

You know the right answer?

Look Manufacturing Corporation has a traditional costing system in which it applies manufacturing ov...

Questions

Mathematics, 29.08.2019 07:10

Business, 29.08.2019 07:10

English, 29.08.2019 07:10

English, 29.08.2019 07:10

Mathematics, 29.08.2019 07:10

Mathematics, 29.08.2019 07:10

Mathematics, 29.08.2019 07:10

English, 29.08.2019 07:10

English, 29.08.2019 07:10

English, 29.08.2019 07:10