Business, 18.01.2021 21:10 katdoesart65091

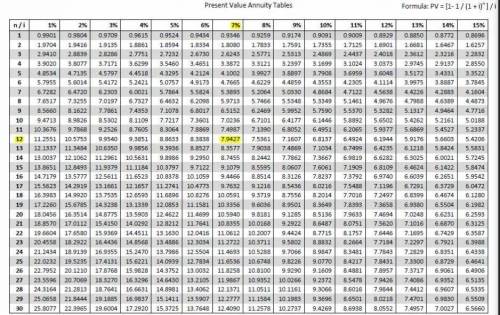

You just won the Powerball and are offered two payment options: 1) Receiving $80 million per year for 25 years beginning at next year. 2) Receiving $850 million today. What do you choose if r

Answers: 1

Another question on Business

Business, 21.06.2019 23:00

Walmart’s scm system walmart is famous for its low prices, and you may have experienced its low prices first-hand. at least, you have probably seen its motto, “always low prices— always.” one of the biggest reasons walmart is able to sell at prices lower than almost everyone else is that it has a superefficient supply chain. its it-enabled supply chain management system is the envy of the industry because it drives excess time and unnecessary costs out of the supply chain. so, because walmart can buy low, it sells low. as a matter of fact, if your company wants to sell items to walmart for it to sell in its stores, you will have to do business with it electronically. if your company can’t do that, walmart won’t buy anything from you. log on to walmart’s web site (), search for supplier information, and find out what walmart’s requirements are for its suppliers to do business with it electronically. prepare a brief summary of its requirements for presentation in clas

Answers: 3

Business, 22.06.2019 03:00

Afirm's before-tax cost of debt, rd, is the interest rate that the firm must pay on debt. because interest is tax deductible, the relevant cost of debt used to calculate a firm's wacc is the cost of debt, rd (1 – t). the cost of debt is used in calculating the wacc because we are interested in maximizing the value of the firm's stock, and the stock price depends on cash flows. it is important to emphasize that the cost of debt is the interest rate on debt, not debt because our primary concern with the cost of capital is its use in capital budgeting decisions. the rate at which the firm has borrowed in the past is because we need to know the cost of capital. for these reasons, the on outstanding debt (which reflects current market conditions) is a better measure of the cost of debt than the . the on the company's -term debt is generally used to calculate the cost of debt because more often than not, the capital is being raised to fund -term projects. quantitative problem: 5 years ago, barton industries issued 25-year noncallable, semiannual bonds with a $1,600 face value and a 8% coupon, semiannual payment ($64 payment every 6 months). the bonds currently sell for $845.87. if the firm's marginal tax rate is 40%, what is the firm's after-tax cost of debt? round your answer to 2 decimal places. do not round intermediate calcu

Answers: 3

Business, 22.06.2019 11:00

Factors like the unemployment rate,the stock market,global trade,economic policy,and the economic situation of other countries have no influence on the financial status of individuals. true or false

Answers: 1

Business, 22.06.2019 11:40

During 2016, nike inc., reported net income of $3,760 million. the company declared dividends of $1,022 million. the closing entry for dividends would include which of the following? select one: a. credit cash for $1,022 million b. credit dividends for $1,022 million c. debit net income for $1,022 million d. credit retained earnings for $1,022 million e. debit dividends for $1,022 million

Answers: 1

You know the right answer?

You just won the Powerball and are offered two payment options: 1) Receiving $80 million per year fo...

Questions

History, 17.07.2020 23:01

Mathematics, 17.07.2020 23:01

Mathematics, 17.07.2020 23:01

Mathematics, 17.07.2020 23:01

Mathematics, 17.07.2020 23:01