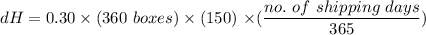

A manager must make a decision on shipping. There are two shippers, A and B. Both offer a two-day rate: A for $504 and B for $526. In addition, A offers a three-day rate of $472 and a nine-day rate of $410, and B offers a four-day rate of $452 and a seven-day rate of $428. Annual holding costs are 30 percent of unit price. Three hundred and sixty boxes are to be shipped, and each box has a price of $150. Which shipping alternative would you recommend? (Round your intermediate calculations to 3 decimal places and final answers to 2 decimal places. Omit the "$" sign in your response.)

A B

Option Cost Option Cost

2 days $ 2 days $

3 days $ 4 days $

9 days $ 7 days $

a. Ship two-day using A

b. Ship three-day using A

c. Ship two-day using B

d. Ship four-day using B

e. Ship seven-day using B

Answers: 3

Another question on Business

Business, 21.06.2019 18:40

Reactive power generation has the following capital structure. its corporate tax rate is 40%. security market value required rate of return debt $ 30 million 4 % preferred stock 30 million 6 common stock 40 million 10 what is its wacc? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.)

Answers: 2

Business, 22.06.2019 12:30

howard, fine, & howard is an advertising agency. the firm uses an activity-based costing system to allocate overhead costs to its services. information about the firm's activity cost pool rates follows: stooge company was a client of howard, fine, & howard. recently, 7 administrative assistant hours, 3 new ad campaigns, and 8 meeting hours were incurred for the stooge company account. using the activity-based costing system, how much overhead cost would be allocated to the stooge company account?

Answers: 1

Business, 22.06.2019 14:30

If a product goes up in price, and the demand for it drops, that product's demand is a. elastic b. inelastic c. stable d. fixed select the best answer from the choices provided

Answers: 1

Business, 22.06.2019 20:00

Beranek corp has $720,000 of assets, and it uses no debt--it is financed only with common equity. the new cfo wants to employ enough debt to raise the debt/assets ratio to 40%, using the proceeds from borrowing to buy back common stock at its book value. how much must the firm borrow to achieve the target debt ratio? a. $273,600b. $288,000c. $302,400d. $317,520e. $333,396

Answers: 3

You know the right answer?

A manager must make a decision on shipping. There are two shippers, A and B. Both offer a two-day ra...

Questions

Advanced Placement (AP), 18.04.2020 07:02

Computers and Technology, 18.04.2020 07:02

Mathematics, 18.04.2020 07:02

Mathematics, 18.04.2020 07:02

Mathematics, 18.04.2020 07:02

English, 18.04.2020 07:02

Computers and Technology, 18.04.2020 07:02

Geography, 18.04.2020 07:02

Mathematics, 18.04.2020 07:02

Mathematics, 18.04.2020 07:02

Geography, 18.04.2020 07:02

History, 18.04.2020 07:02

![Cost = 504 + \Big [ 0.30 \times (360 ) \times (150) \times (\dfrac{2}{365}) \Big ]](/tpl/images/1007/6788/cc6cf.png)

![Cost = 526 + \Big [ 0.30 \times (360 ) \times (150) \times (\dfrac{2}{365}) \Big ]](/tpl/images/1007/6788/40c91.png)

![Cost = 472 + \Big [ 0.30 \times (360 ) \times (150) \times (\dfrac{3}{365}) \Big ]](/tpl/images/1007/6788/6563d.png)